¿Cuánto durará la fiesta de acciones 'Magnificent 7'?

Enfocarse solo en un grupo de inversiones puede ser costoso, advierten los expertos

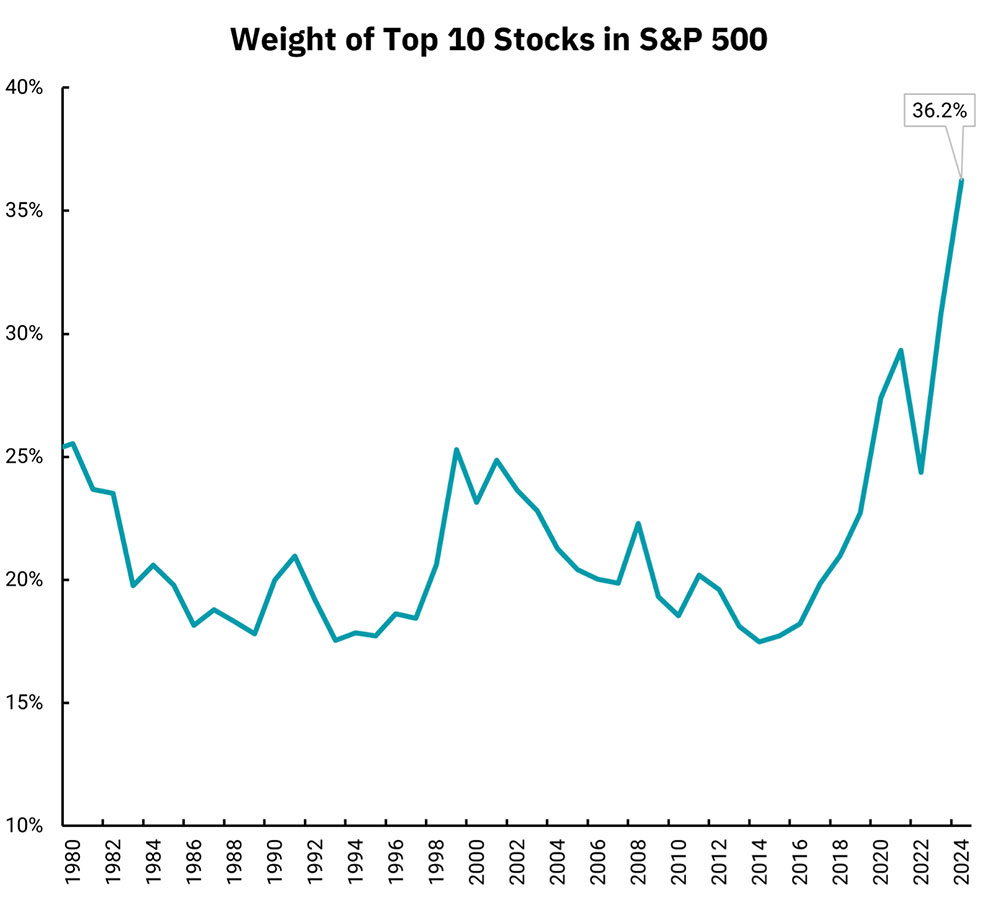

A lo largo de 2023 y gran parte de 2024, un puñado de acciones tecnológicas de gran capitalización conocidas como "Magnífico 7" ancló las ganancias del S&P 500. Como resultado, muchos inversores acudieron en masa al Mag 7, montando los faldones de los nombres más importantes en computación en la nube, inteligencia artificial (IA) y tecnologías móviles, pero a costa de la diversificación de la cartera. Y así, al entrar en 2025, abundan las preguntas: ¿Cuánto durará la fiesta Mag 7? ¿El resto del mercado tirará de su peso este año? ¿Y sigue siendo válida la sabiduría convencional de una cartera ampliamente diversificada?

Los resultados de las 2024 elecciones presidenciales pueden ofrecer algunas ideas tempranas, según Brian Henderson, director de inversiones de BOK Financial®. Por ejemplo, los aranceles propuestos por Trump deberían fortalecer el dólar estadounidense, lo que tiende a ayudar a las empresas pequeñas y medianas y, a su vez, a sus acciones.

"Ya estamos viendo un mejor desempeño de las acciones de pequeña y mediana capitalización, y creo que se debe en gran medida a la anticipación de que Trump podrá aprobar sus políticas económicas", dijo.

En deferencia a los titanes tecnológicos

Sin embargo, todavía hay mucha evidencia que sugiere que el Mag 7 tendrá otro año fuerte, dijo Wes Verdel, gerente senior de cartera de acciones cuantitativas de Cavanal Hill Investment Management, Inc., que es una subsidiaria de BOKF, NA.

"Hay buenas razones por las que a estas compañías les ha ido tan bien como lo han hecho", dijo. "Son empresas de alta tecnología que dependen principalmente de los trabajadores del conocimiento (a diferencia del trabajo manual y las enormes inversiones de capital); Tienen la flexibilidad de expandirse por todo el mundo y hacer correcciones de rumbo con relativa facilidad. El poder de su propia tecnología, incluida la IA, también les ayuda a mejorar y reinventarse continuamente, por lo que no es irrazonable pensar que sus acciones continuarán subiendo".

La diversificación sigue teniendo sentido

Sin embargo, incluso con los vientos de cola que continúan beneficiando a las acciones de Mag 7, hacer apuestas descomunales en un pequeño puñado de acciones no es la mejor estrategia para la mayoría de los inversores a largo plazo, dijo Liu Liu, director de investigación y gestión de inversiones en BOK Financial.

"Estamos empezando a ver que el mercado se amplía. Y esto puede continuar a medida que la política monetaria se relaje aún más y cree condiciones más favorables para los negocios para todas las empresas, no solo para las empresas de tecnología".- Liu Liu, directora de investigación y administración de inversiones de BOK Financial

"A largo plazo, seguimos creyendo que la diversificación sensata no solo entre acciones, sino entre diferentes clases de activos, como renta fija, acciones y alternativas, es la mejor apuesta", dijo.

Vea el mercado con una lente gran angular

Como siempre, el desempeño del mercado de valores depende de factores macro y microeconómicos, por lo que si bien descifrar las hojas de té de los indicadores económicos puede proporcionar información valiosa, Verdel advirtió a los inversores que no se fijen demasiado en una sola cosa.

"Todos estos problemas -inflación, desempleo, gasto público y crecimiento económico- juegan un papel combinado en el rendimiento de las acciones. Pero poner demasiado peso en cualquier recorte de tasas de titulares, por ejemplo, podría producir una imagen incompleta", dijo.

Liu se hizo eco de ese sentimiento, recomendando que los inversores revisen los enfoques probados de asignación de activos.

"Dado que las acciones terminaron el año fuertes, las asignaciones de activos de muchos inversores ahora pueden estar sobreponderadas en acciones. Ahora sería un buen momento para reequilibrar su cartera para garantizar la combinación óptima de riesgo y recompensa para sus objetivos", dijo. "A medida que comenzamos 2025, ahora puede ser el momento de buscar oportunidades de recolección de pérdidas fiscales, vender las inversiones perdedoras para ayudar a compensar los impuestos a las ganancias de capital en los que pueda incurrir".

No importa hacia dónde se dirijan las acciones este año, el valor de un horizonte a largo plazo y el asesoramiento financiero profesional no pueden ser exagerados, dijo Liu.

"En comparación con intentar cronometrar el mercado, la gran mayoría de los inversores estarían mejor atendidos trabajando con un asesor calificado para implementar principios de inversión probados y verdaderos durante muchos años", dijo.

PRODUCTOS DE INVERSIONES Y SEGUROS: NO ASEGURADOS POR LA FDIC | SIN AVAL DEL BANCO O SUS AFILIADAS | SIN DEPÓSITOS | SIN SEGURO DE AGENCIAS FEDERALES DEL GOBIERNO | PUEDEN PERDER VALOR.

El contenido de este artículo tiene fines informativos y educativos solamente, y no debe interpretarse como asesoramiento legal, impositivo o de inversión. Siempre consulte a un profesional financiero, contador o abogado calificado si desea recibir asesoramiento legal, impositivo o sobre inversiones. Ni BOK Financial Corporation ni sus afiliadas ofrecen asesoramiento legal.

2025 Perspectivas

Un nuevo año a menudo se asocia con la transformación. Aun así, el grado de cambio que se avecina en 2025 parece inusualmente grande para los Estados Unidos, con posibles cambios en la política comercial, la inmigración, la regulación y más. El equipo de administración de inversiones de BOK Financial ha preparado su perspectiva de los 2025 mercados como un informe descargable, artículos complementarios y un seminario web grabado.