Las pequeñas empresas son un gran negocio para los empresarios hispanos

Este grupo tiene tres veces más probabilidades de abrir un negocio

PUNTOS CLAVE

- Crecimiento rápido: Las empresas propiedad de hispanos están creciendo a una tasa anual del 34%, contribuyendo con más de $800 mil millones a la economía de los Estados Unidos anualmente.

- Impulsores clave: El crecimiento de la población, la mejora del acceso al capital y la adopción de tecnología están alimentando este aumento empresarial.

- Desafíos: A pesar del éxito, los empresarios hispanos enfrentan barreras como el acceso limitado al crédito y obstáculos culturales, pero las iniciativas están ayudando a cerrar estas brechas.

A pesar de su etiqueta, las pequeñas empresas ocupan un lugar importante en los Estados Unidos y una comunidad, en particular, está aprovechando la oportunidad. Estados Unidos está experimentando una notable transformación en su panorama empresarial, con los empresarios hispanos emergiendo como uno de los segmentos de más rápido crecimiento de la comunidad empresarial de la nación, según el Comité Económico Conjunto del Senado de los Estados Unidos.

Esta comunidad es uno de los grupos con más espíritu emprendedor de la nación, dijo Jhoanna Astudillo, líder del segmento hispano de BOK Financial®.

"Las empresas propiedad de hispanos son una gran potencia económica y contribuyen con más de $800 mil millones a la economía estadounidense anualmente", dijo Astudillo. "También tienen tres veces más probabilidades de abrir un negocio que la población general".

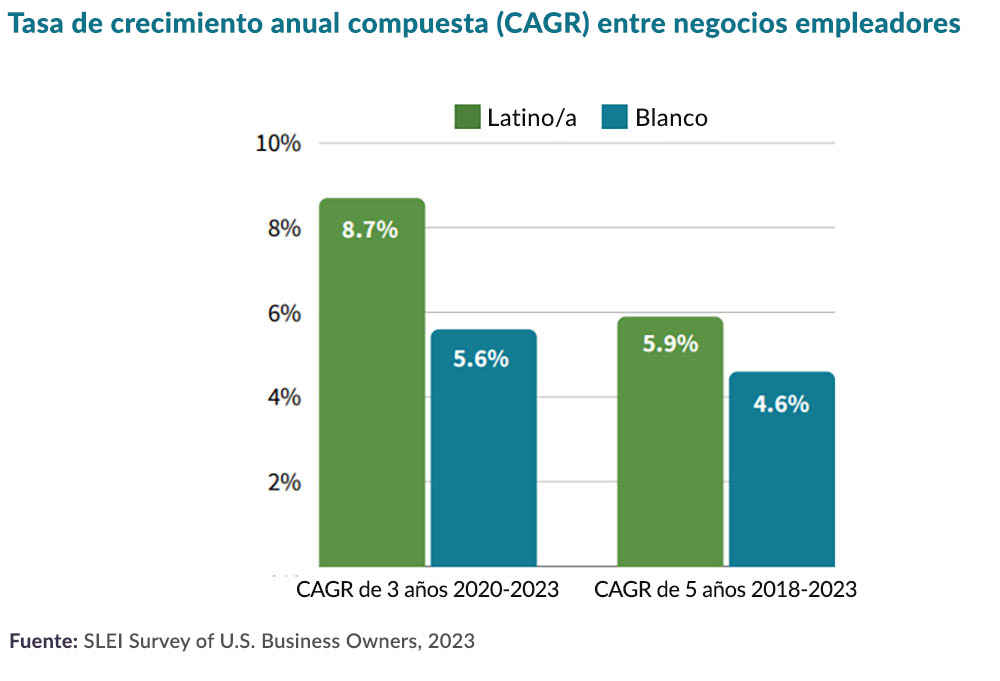

En los últimos tres años, el país ha visto la tasa de creación más rápida de pequeñas empresas propiedad de latinos en más de una década. El Comité Económico Conjunto de los Estados Unidos estima que las empresas propiedad de hispanos crecieron a una tasa anual del 34% entre 2019 y 2023, superando fuertemente la tasa general de crecimiento empresarial de los Estados Unidos de solo el 1%.

Los 2023 años de la Iniciativa de Emprendimiento Latino de Stanford Informe sobre el Estado del Emprendimiento Latino reveló que los hispanos contribuyen colectivamente con $3.2 billones a través de la propiedad de casi 5 millones de empresas. La Administración de Pequeños Negocios también ha informado que el 80% de los propietarios de negocios latinos dicen que su negocio ha crecido en el último año, un 7% más que el promedio nacional.

Principales impulsores del crecimiento

Varios factores contribuyen a esta oleada empresarial.

Crecimiento de la población: La población hispana en Estados Unidos está creciendo rápidamente, creando una expansión natural de la propiedad de negocios. Pero según Astudillo, es más que solo números. "Los empresarios hispanos son muy buenos para detectar oportunidades y muchos, especialmente los inmigrantes, no tienen miedo de correr riesgos".

Las empresas propiedad de latinos abarcan varios sectores, con concentraciones notables en ciertas industrias. La construcción, el alojamiento y el servicio de comida, y los servicios profesionales lideran el camino, según datos de la Oficina del Censo. Los negocios administrativos, de atención médica y minoristas completan los seis principales sectores comerciales para los propietarios de negocios hispanos.

Mejora del acceso al capital: El acceso al capital ha mejorado, aunque persisten desafíos. Las instituciones financieras están reconociendo el potencial de apoyar a los empresarios, y algunas han desarrollado programas especializados para propietarios de negocios hispanos.

"Reconocemos el crecimiento significativo y la demografía juvenil de la población hispana/latina", dijo Astudillo. "Estamos viendo el segmento de más rápido crecimiento de la población que también tiende a sesgar más joven que la población general. Nuestro objetivo es aprovechar nuestros esfuerzos existentes y abrir nuevas oportunidades para el éxito mutuo.

Adopción de tecnología: La adopción de tecnología también ha jugado un papel, según el Informe del Estado del Emprendimiento Latino. Este grupo demográfico ha demostrado una aptitud particular para aprovechar la IA, las plataformas digitales y las soluciones de comercio electrónico para llegar a mercados más amplios.

Aumento del espíritu empresarial general: Comenzar un negocio generalmente está en aumento, en todos los grupos demográficos. Hubo casi 1,8 millones de aplicaciones empresariales de alta propensión en 2023, frente a los 1,3 millones en 2019, según un informe de 2024 Pew Research.

Estas empresas son importantes creadoras de empleo, con empresas de propiedad hispana que emplean a millones de estadounidenses en diversos sectores. El efecto multiplicador de estas empresas se extiende más allá del empleo directo, apoyando las cadenas de suministro y estimulando la actividad económica local.

¿Qué sigue?

Sin embargo, a pesar del impresionante crecimiento, los empresarios hispanos enfrentan distintos desafíos. Las empresas propiedad de latinos son algunas de las oportunidades de mayor potencial pero más pasadas por alto para los inversionistas. Históricamente, no han buscado financiamiento en ningún lugar cerca de los mismos niveles que sus contrapartes. Aunque es probable que las empresas propiedad de latinos soliciten financiamiento de los bancos, son prestatarios más tentativos, que buscan cantidades más pequeñas de financiamiento, según un Informe de Bain & Company. Si las empresas latinas existentes estuvieran totalmente financiadas, podrían generar $ 1.4 billones en ingresos adicionales hoy y $ 3.3 billones en ingresos adicionales para 2030, según el informe.

Astudillo señala que hay varias razones por las que los hispanos carecen de acceso al crédito, incluidas las barreras culturales y lingüísticas, que pueden presentar obstáculos para navegar por el sistema bancario de los Estados Unidos y acceder a los recursos. Explicó que muchos dueños de negocios latinos que conoce usan sus propios ahorros para iniciar sus negocios y asumen que nunca calificarán para un préstamo o crédito.

"Crear crédito lleva tiempo, por lo que si bien es posible que inicialmente no califiquen, podrían hacerlo en el futuro", dijo. "Nuestro objetivo es ayudar a los clientes a construir patrimonio y alcanzar sus metas financieras. Lo hacemos de diferentes maneras, pero primero brindando educación financiera y enseñando a las personas cómo aprovechar los recursos bancarios".

Ella cita las tendencias positivas reportadas por la Iniciativa de Emprendimiento Latino de Stanford, que muestra que las empresas propiedad de latinos están creciendo en ingresos anuales más rápido que otros grupos demográficos y tienen un 11% más de probabilidades de tener un puntaje de crédito comercial saludable por encima de 680.

Y Astudillo no ve ninguna señal de desaceleración. "El hecho de que esta población continúe creciendo, y ya estén abriendo negocios a un ritmo vertiginoso, apuntan a una mayor expansión en el futuro", dijo.

Las iniciativas del sector privado también sugieren un ecosistema mejorado para el espíritu empresarial hispano, al igual que las crecientes tasas de educación de esta población.

A medida que Estados Unidos continúa evolucionando, Astudillo es optimista de que las empresas propiedad de hispanos probablemente desempeñarán un papel cada vez más importante en la configuración del futuro económico de la nación.