La carrera por la IA se expande más allá de EE. UU. y China

'Hiperescaladores' buscan ofertas de energía para el futuro, necesidades de energía potencialmente masivas

PUNTOS CLAVE

- Las empresas "hiperescaladoras" como Amazon, Meta, Alphabet / Google, Microsoft y Oracle están compitiendo entre sí para desarrollar IA avanzada y centros de datos.

- Las compañías tecnológicas y los líderes políticos ahora buscan construir centros de datos en lugares con una abundancia de energía barata y confiable y terrenos de bajo costo como el Medio Oriente.

- El acceso a la energía, en particular, el gas natural, será un factor clave en el futuro, así como el acceso a metales de tierras raras como el grafito, el titanio, el litio y el berilo.

A principios de este año, las discusiones sobre la carrera para desarrollar una IA más avanzada se centraron en la startup china DeepSeek y si el nuevo modelo de IA que desarrolló podría casi igualar a sus competidores desarrollados en Estados Unidos, mientras que solo tomaría una fracción del tiempo y el costo para construir.

Afirmaciones de DeepSeek Hizo tambalearse a los mercados financieros, enviando las acciones de compañías de tecnología con sede en Estados Unidos como Nvidia a caer por las preocupaciones sobre el liderazgo de Estados Unidos en el sector de la inteligencia artificial (IA), así como las grandes cantidades de dinero que estas compañías estadounidenses han invertido en modelos y centros de datos de IA.

Medio año después, parece que Afirmaciones de DeepSeek fueron "en gran medida exagerados, pero alentaron a las empresas estadounidenses a acelerar el desarrollo", dijo Matt Stephani, presidente de Cavanal Hill Investment Management, Inc., una subsidiaria de BOK Financial Corporation.

"Habrá ganadores y perdedores. Habrá adoptantes tempranos, habrá quienes sean seguidores rápidos, y luego estarán las compañías "tardías". Creo que los ganadores serán los primeros en adoptarlo bien".- Matt Stephani, presidente de Cavanal Hill Investment Management

En los Estados Unidos, la carrera es en gran parte entre los "hiperescaladores": compañías como Amazon, Meta, Alphabet / Google, Microsoft y Oracle. Entre estas compañías, no hay un verdadero precursor, según Stephani. "Todos están trabajando en proyectos que se saltan entre sí uno a la vez".

Mirando hacia el futuro, las compañías que terminen siendo las rezagadas serán las que cometan errores importantes en la expansión de la IA y los centros de datos, o las que no pongan suficiente dinero en el espacio, supuso Stephani.

Dinero, energía confiable, metales raros necesarios para "ganar" en el espacio de IA

Desarrollar modelos avanzados de IA no es barato, como se refleja en los grandes gastos de capital de los hiperescaladores. Por ejemplo, Presupuesto de gastos de capital de 2025 de Amazon se proyecta que superará la balanza en $ 100 mil millones. Stephani estima que, en total, los 2025 presupuestos de gastos de capital de Oracle, Microsoft, Alphabet, Amazon y Meta totalizarán alrededor de $ 340 mil millones. Afortunadamente, tienen el dinero para pagarlo, teniendo un total combinado de $ 360 mil millones de efectivo en sus balances, según los cálculos de Stephani.

Pero se necesita más que dinero para ganar el desarrollo y el poder de una IA cada vez más avanzada.

Por esta razón, la carrera se está convirtiendo en un fenómeno global, ya que las empresas y los líderes políticos buscan lugares con una abundancia de energía barata y confiable y tierras de bajo costo como el Medio Oriente, dijo Stephani.

El niño del cartel de esta carrera es actualmente Stargate Emiratos Árabes Unidos, que sería uno de los centros de datos más grandes del mundo cuando esté terminado. El acuerdo multimillonario, financiado por el holding emiratí de desarrollo de IA G42, se construiría en los Emiratos Árabes Unidos (EAU) utilizando tecnología estadounidense de compañías como Nvidia, OpenAI, Cisco y Oracle, junto con SoftBank de Japón. Se estima que la primera fase estará en línea en 2026, pero algunas preocupaciones de Estados Unidos sobre las condiciones de seguridad continúan persistiendo, lo que está dificultando la finalización del acuerdo.

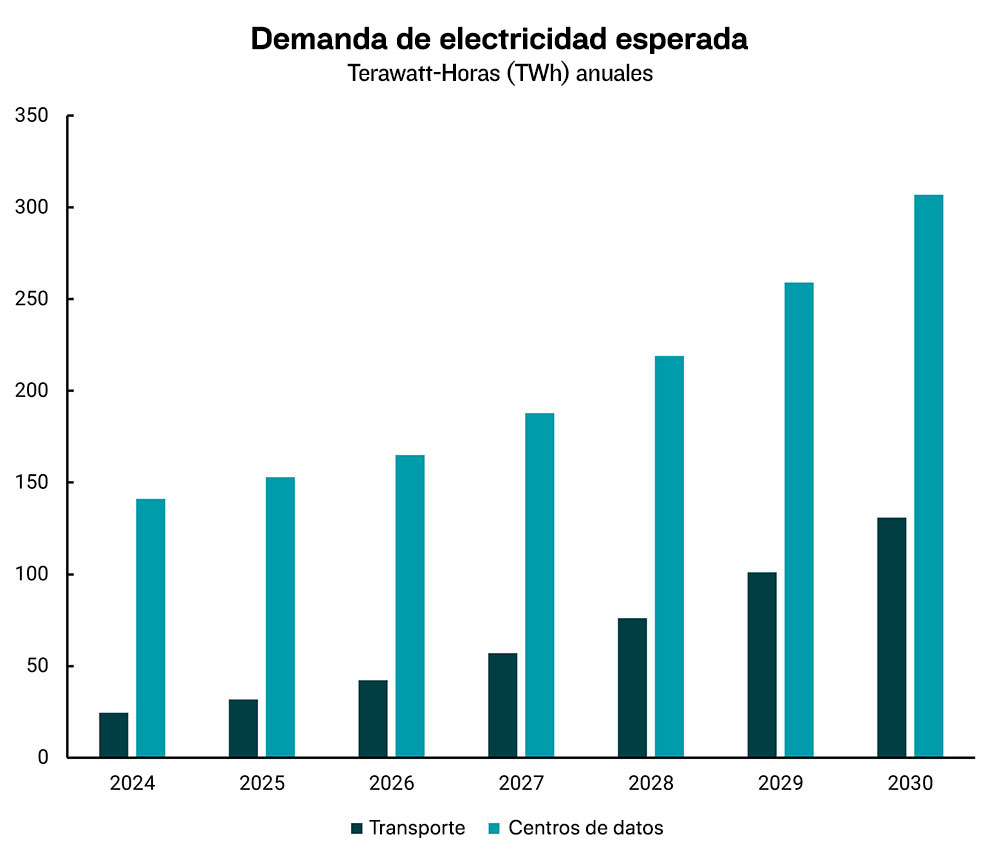

Stephani cree que una de las razones por las que los gigantes tecnológicos están mirando a Oriente Medio es la abundancia de gas natural en la región, lo que podría ayudar a satisfacer las inmensas necesidades de energía de los centros de datos. Solo en los Estados Unidos, se espera que la expansión de los centros de datos tradicionales y de IA y las fundiciones de chips aumente la demanda de energía más del doble, de 2023 a 2030, a alrededor de 307 teravatios-hora (TWh), según un informe de Rystad Energy. Para poner este número en perspectiva, el todo el consumo de electricidad en los EE.UU. fue 4,010 (TWh) en 2022.

Debido a la inmensidad de esta demanda, los centros de datos no necesitan cualquier energía, sino energía barata y confiable, como el gas natural y la nuclear, dijo Stephani. Ser el mayor proveedor mundial de gas natural puede dar a EE.UU. una ventaja a ese respecto; sin embargo, fuera de los EE.UU. aliados como Rusia, China e Irán conforman los otros cuatro principales proveedores mundiales de gas natural, según la Agencia Internacional de Energía (AIE). 2022 Clasificación.

Mientras tanto, otro factor en la carrera de la IA es el acceso a metales de tierras raras como grafito, titanio, litio y berilo, señaló el director de inversiones de BOK Financial® Brian Henderson. Y aquí es donde Estados Unidos puede tener dificultades, incluso con su significativo Reservas de cobre, otro metal clave. China produce el 60% de los metales de tierras raras del mundo y procesa casi el 90%, lo que "le ha dado a China un casi monopolio". Según el comentario por el Centro de Estudios Estratégicos e Internacionales con sede en Washington.

Una forma en que la administración Trump ha tratado de reducir su dependencia de China para los metales de los que carece Estados Unidos fue a través de un acuerdo con Ucrania, que también tiene depósitos. Eso le habría dado a Estados Unidos miles de millones de dólares en minerales ucranianos como reembolso por la ayuda militar, explicó Henderson. Sin embargo, el acuerdo final incluía una provisión para que Estados Unidos se deshaga de los recursos minerales futuros en "términos comerciales basados en el mercado", pero no como Trump quería.

Es por estas razones que la energía, la política comercial, la geopolítica y la tecnología se entrelazan, dijo Henderson. "Las políticas de Trump son desde la perspectiva de que 'Estados Unidos es actualmente el país más poderoso del mundo, y estos cambios de política son para mantener este poder global en el futuro'".

Para profundizar en la IA y su impacto potencial en los empleos y la industria energética, Matt Stephani se sentó con Tulsa's News en 6 / KOTV. Vea el Segmento completo.

Perspectivas sobre el mercado a mitad de año 2025

La primera mitad de 2025 ha estado llena de acontecimientos, por decir lo menos. Algunos de los factores geopolíticos que contribuyen a esta incertidumbre parecen haber disminuido un poco, pero los impactos económicos de los aranceles y una política de inmigración más estricta permanecen. Para brindar una perspectiva sobre estos temas y más, nuestro equipo de administración de inversiones ha preparado un informe detallado, artículos y seminarios web como su perspectiva de mitad de año.