Sopesar el "dolor" y la "ganancia" de los aranceles

La política comercial apunta a hacer que la economía estadounidense sea más resistente, pero con los costos potenciales de una mayor inflación y tasas de interés

PUNTOS CLAVE

- En el corto plazo, los consumidores y las empresas pueden experimentar una mayor inflación y tasas de interés debido a los aranceles.

- A largo plazo, los aranceles podrían generar una economía estadounidense más resistente e independiente.

- Si la fabricación estadounidense aumenta depende de una serie de factores, incluido cuánto tiempo piensan los responsables de la toma de decisiones corporativas que durarán los aranceles.

Hablando en sentido figurado, la economía de los Estados Unidos va al gimnasio, y se lleva a los consumidores y las empresas con él. Mientras tanto, los impactos se están sintiendo en todo el mundo.

"Los aranceles, la política fiscal, la política energética, la regulación, todos estos cambios se están moviendo muy rápido porque el presidente Trump sabe que tiene un corto período de tiempo, y habrá algo de dolor económico en el proceso", dijo Steve Wyett, jefe de estrategias de inversión de BOK Financial®. "Trump está tratando de llevar a la economía a través de este dolor inicial a un punto en el que se puedan ver algunos de los beneficios, por lo que habrá motivación para continuar en ese camino. Sin embargo, con la llegada de los exámenes parciales, hay que considerar el momento del 'dolor versus ganancia'".

Wyett compara el dolor económico que los consumidores y las empresas pueden estar sintiendo ahora por el aumento de la incertidumbre, la volatilidad del mercado financiero, la inflación más alta y las tasas de interés más altas por más tiempo con el dolor físico que alguien siente cuando comienza a ir al gimnasio. Al principio, hay dolor muscular y cansancio, pero con el tiempo, si la persona sigue haciendo ejercicio, comenzará a ver los beneficios. Pero primero deben superar el período de dolor.

Los aranceles y los cambios impositivos pueden estimular la manufactura estadounidense

Con la evolución de los aranceles implementados por la administración Trump, esta vez en el "gimnasio" podría producir una economía estadounidense más independiente y resistente, así como un posible resurgimiento de la fabricación estadounidense. Como dijo Wyett: "Si Estados Unidos se encuentra en una posición en la que dependemos en gran medida de un país extranjero para un bien o servicio, corremos el riesgo de no poder obtener ese bien y servicio, ya sea un aliado o no".

Sin embargo, esos objetivos finales tomarán tiempo, con costos financieros potenciales para los consumidores y las empresas estadounidenses en el camino, advirtieron él y otros expertos. Por ejemplo, es posible que la Reserva Federal no pueda reducir tanto las tasas de interés, y las tasas hipotecarias también pueden mantenerse más altas este año.

Para obtener una perspectiva sobre estos costos adicionales para lograr el objetivo de la resiliencia de los Estados Unidos, Wyett dio la analogía de un modelo de negocio. "Un modelo de negocio resiliente no es el modelo de negocio más barato", dijo. "No construyes resiliencia para manejar todo cuando las cosas van bien. Construyes resiliencia, para que puedas mantenerte en el negocio cuando las cosas no van bien. Sin embargo, al hacer eso, estás asumiendo un costo adicional para tener esa resiliencia".

Los aranceles y los cambios en el impuesto corporativo están destinados a trabajar juntos para ayudar a construir esa resiliencia al desalentar las exportaciones extranjeras a los Estados Unidos y alentar a las empresas estadounidenses a realizar sus operaciones y fabricar a nivel nacional, señaló Brian Henderson, director de inversiones de BOK Financial.

"El presidente Trump cree que, si los impuestos corporativos son lo suficientemente bajos y los aranceles son lo suficientemente altos, será muy punitivo para las empresas que no tienen operaciones aquí simplemente exportar bienes a los Estados Unidos", dijo.

Por ejemplo, uno de los aspectos más pasados por alto, pero importantes, de la "Ley One Big Beautiful Bill" permitirá a las empresas estadounidenses gastar completamente el dinero gastado en instalaciones de fabricación en el primer año, señaló Matt Stephani, presidente de Cavanal Hill Investment Management, Inc. "Creo que los efectos van a ser mucho más grandes de lo que la gente piensa ahora y en los próximos 10 años", dijo. "Espero que eso ayude a impulsar la inversión en Estados Unidos para reconstruir nuestro sector manufacturero".

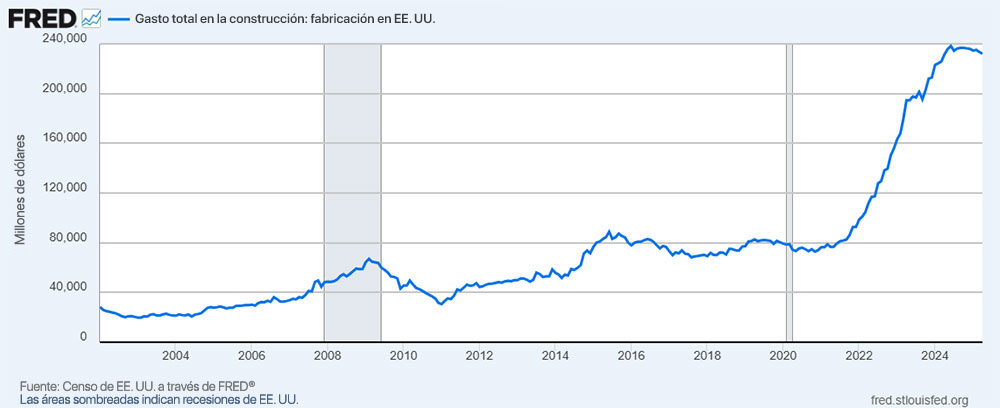

Ya gasto en la construcción de instalaciones de fabricación en Estados Unidos ha aumentado considerablemente en los últimos cinco años, aunque ha disminuido ligeramente en los últimos meses a medida que las empresas lidian con la incertidumbre, según datos del Banco de la Reserva Federal de St. Louis.

Queda por ver el alcance y la duración de los cambios

Mirando hacia el futuro, cuánto están dispuestas a gastar las empresas extranjeras para construir instalaciones en los Estados Unidos, en lugar de solo exportar bienes a los Estados Unidos, depende de cuán duraderas piensen que serán las políticas comerciales, señaló Stephani. "Si una empresa tiene una gran instalación que necesita construir en los Estados Unidos, realmente tiene que hacer un cálculo de si la tarifa se mantendrá o no, y esa no es una respuesta simple. Pueden decidir esperar y ver".

Otra pregunta general es cuánto comercio global será remodelado por los cambios de política comercial de la administración Trump. Aunque el valor del dólar estadounidense ha estado cayendo frente a otras monedas, lo que hace que las exportaciones estadounidenses sean más competitivas, sigue siendo la moneda de reserva mundial, por lo que siempre hay demanda, señaló Stephani. Ese es un factor que trabaja en contra de la remodelación del comercio mundial.

Sin embargo, al mismo tiempo, ya ha comenzado cierta remodelación del comercio mundial como parte de la desglobalización en curso estimulada por la pandemia de Covid y la polarización de la política mundial, dijo Stephani.

Otra pregunta persistente rodea estos cambios en la política comercial de Estados Unidos que coinciden con factores geopolíticos como la alianza de Irán, China y Rusia por un lado y Estados Unidos y sus aliados por el otro, continuó.

"Trump está tratando de abordar los desequilibrios comerciales que ve, pero el hecho es que lo está haciendo en un contexto en el que el mundo está empezando a fracturarse", dijo Stephani.

Perspectivas sobre el mercado a mitad de año 2025

La primera mitad de 2025 ha estado llena de acontecimientos, por decir lo menos. Algunos de los factores geopolíticos que contribuyen a esta incertidumbre parecen haber disminuido un poco, pero los impactos económicos de los aranceles y una política de inmigración más estricta permanecen. Para brindar una perspectiva sobre estos temas y más, nuestro equipo de administración de inversiones ha preparado un informe detallado, artículos y seminarios web como su perspectiva de mitad de año.