Por qué la Fed ve la "no acción" como la mejor medida por ahora

¿Esperarán demasiado tiempo para bajar, o incluso aumentar, las tasas?

Después de cada reunión del brazo de fijación de tasas de la Reserva Federal, el Comité Federal de Mercado Abierto (FOMC), obtenemos una declaración resumida de las discusiones de las reuniones (que no debe confundirse con las actas reales de las reuniones que se publican después de un período de cada reunión). El presidente de la Fed, Powell, normalmente también celebra una conferencia de prensa para responder preguntas de los periodistas. Además, aproximadamente una vez al trimestre, recibimos su Declaración de Proyecciones Económicas (SEP) actualizada, que el FOMC publicó el 18 de junio. El SEP es donde la Fed proporciona proyecciones numéricas para factores como el producto interno bruto (PIB), la inflación y su objetivo para la tasa de los Fondos Federales. Proporcionan estas estimaciones para marcos de tiempo a corto, mediano y largo plazo, lo que nos ayuda a comprender cómo ven la evolución de la economía desde su estado actual.

Ahora nos encontramos en un período durante el cual no solo hay debate sobre la dirección de sus estimaciones, sino también sobre su evaluación del entorno económico actual. Además, hay incógnitas en torno a los impactos de numerosas decisiones políticas, incluidos los aranceles, la política fiscal, la política regulatoria, el techo de la deuda y la inmigración. Algunos datos, como el desempleo, parecen fuertes en la superficie, mientras que las tendencias subyacentes indican una tendencia al debilitamiento. Algunos datos están mejorando, como la inflación, pero se conocen vientos en contra en el futuro. Además, algunos datos, como la vivienda, están en un mal lugar con precios altos y tasas hipotecarias estancadas en torno al 7%. Luego, hay datos confusos, como el PIB negativo en el primer trimestre, que fue impulsado por un aumento previo a los aranceles en las importaciones que parece estar revirtiéndose este trimestre.

En general, en comparación con la última publicación del SEP, la Fed redujo un poco sus expectativas de crecimiento, elevó un poco sus pronósticos de inflación a corto plazo, mantuvo estable su visión de la tasa neutral a largo plazo, ve que el desempleo aumentará a 4.5% para fin de año y continúa apuntando dos recortes de tasas entre ahora y fin de año. Todos podríamos ser perdonados si leer esta actualización produce más preguntas que respuestas. Un crecimiento más lento y un desempleo más alto hacen que las tasas más bajas sean sensatas, pero no si se espera que la inflación aumente, incluso por un período limitado (no voy a usar la palabra "transitorio").

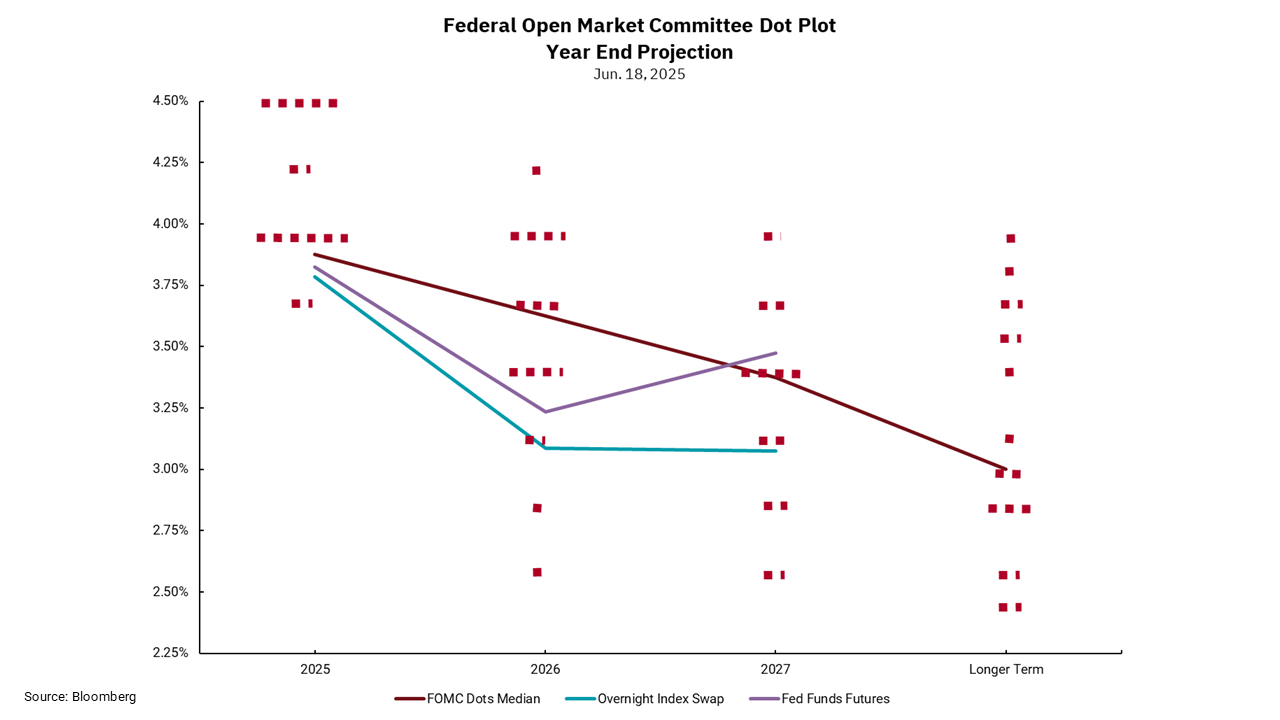

Nuestro gráfico de esta semana, el "diagrama de puntos" de la Fed, no pretende ser una herramienta de pronóstico, aunque puede ser útil ver dónde se encuentra el miembro promedio del comité del FOMC en comparación con los pronósticos basados en el mercado, como el mercado de swaps de índices a un día (OIS) y los futuros de los fondos federales. Sin embargo, para mí, la historia más importante está en la dispersión de opiniones dentro de la comisión. Tenga en cuenta que este comité está compuesto seguramente por algunas de las mentes económicas más brillantes con acceso a resmas de información e investigación. A pesar de esto, su rango de perspectivas para las tasas de interés a corto y largo plazo es extremadamente amplia, lo que indica puntos de vista muy dispares sobre lo que hará la economía a partir de ahora. En un entorno como este, suponiendo que como lo hace la Reserva Federal, no sean demasiado restrictivos o acomodaticios, parece que la mejor acción es no tomar medidas. Por definición, esto significa que la Fed tardará en moverse ya que la mayoría de los datos económicos están rezagados, y las acciones monetarias de la Fed también actúan con un retraso. La única pregunta que queda es si llegarán tarde para subir las tasas o bajarlas.

Obtenga los números entregados en su bandeja de entrada.

Suscríbase (Se abre en una pestaña nueva)