¿Será el dicho: 'Como va NVIDIA, así va Estados Unidos?'

La acción tecnológica fue la primera en romper el nivel de capitalización de mercado de $ 4 billones

Es raro que produzcamos gráficos y comentarios sobre acciones individuales, pero el rendimiento de NVIDIA (NVDA) ha sido espectacular. Los lectores habituales de nuestro trabajo saben que compartimos una perspectiva alcista sobre la inteligencia artificial (IA) y su potencial para marcar el comienzo de una nueva era de ganancias de productividad. Debido a la posición fiscal de los Estados Unidos, el crecimiento económico es de vital importancia.

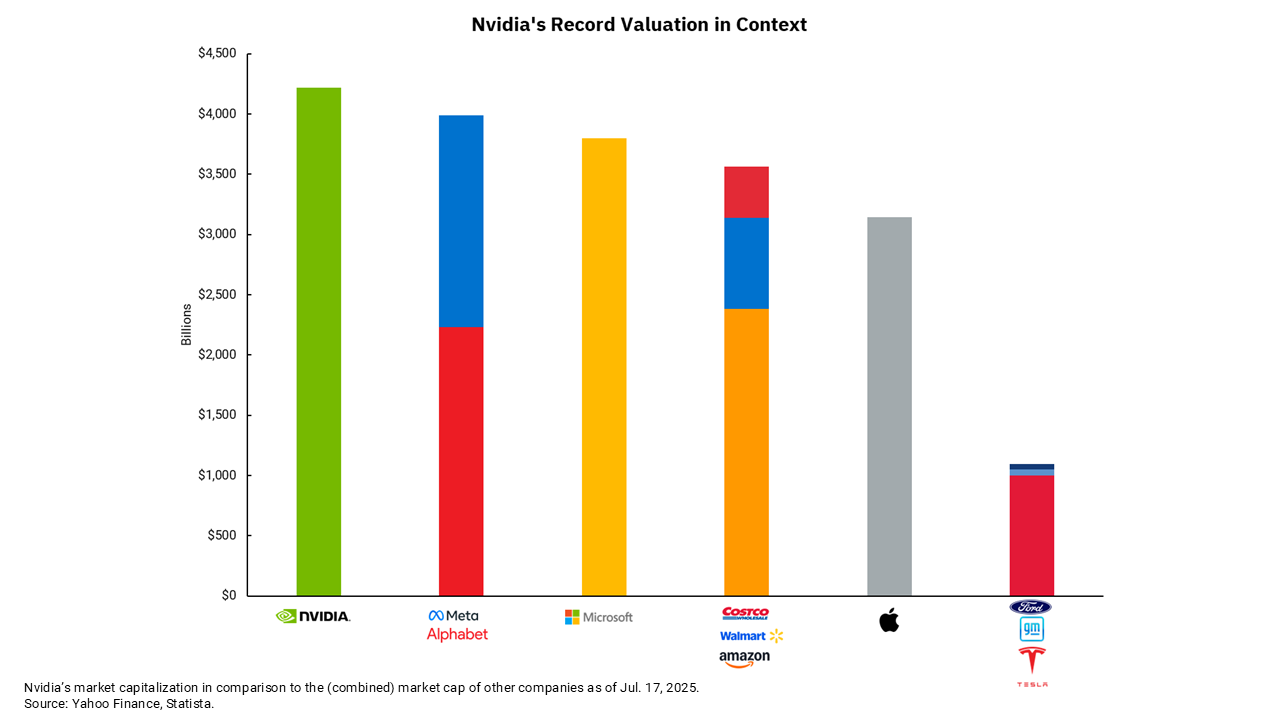

Entonces, con NVDA rompiendo el nivel de capitalización de mercado de $ 4 billones, la primera compañía en hacer eso, parecía un buen momento para considerar el impacto del auge de la IA desde una perspectiva de mercado más amplia. El gráfico que tenemos para esta semana muestra la capitalización de mercado de NVDA frente a algunas otras empresas que cotizan en bolsa. Microsoft es la compañía más cercana en capitalización de mercado y podría muy bien pasar a una capitalización de mercado de $ 4 billones, con Apple (AAPL) en la persecución. Aún así, más allá de eso, vemos que NVDA tiene una capitalización de mercado mayor que el valor combinado de muchas compañías líderes dentro de la economía de los Estados Unidos.

NVDA más grande que la combinación de Facebook (META) y Alphabet (GOOG)? Wow, eso parece extraordinario. Además, podemos agregar Amazon (AMZN), Walmart (WMT) y Costco (COST) y aún estar detrás del valor de NVDA. Y cuando consideramos la importancia del automóvil en nuestra economía, Ford (F), General Motors (GM) y Tesla (TSLA) colectivamente suman alrededor de $ 1 billones en capitalización de mercado total. ¿Quién recuerda cuando el dicho solía ser "Como va GM, así va Estados Unidos"?

Mirando aún más amplio las ponderaciones sectoriales dentro del S&P 500, se vuelve aún más interesante. Solo NVDA representa aproximadamente el 7,6% del índice S&P 500. Por otro lado, las ponderaciones de NVDA, MSFT y AAPL están todas por encima del 5%. ¿Por qué es eso un problema? Para muchos administradores activos, los límites de tamaño de posición son parte de su proceso de gestión de riesgos, e históricamente, cualquier cosa por encima del 5% se ha considerado riesgosa desde un punto de vista fiduciario. Esto significa que muchos gestores activos, por política, tienen una infraponderación en lo que han sido las acciones con mejor rendimiento en el índice. Sin embargo, volviendo a las ponderaciones del sector, NVDA por sí sola es más grande que todo el sector de servicios públicos (2.4% del S&P 500), el sector energético (3.1%) y el sector de consumo básico (5.4%). De hecho, NVDA ahora se está acercando al peso de todo el sector de la salud, que tiene una ponderación del 9,25% en el S&P 500.

No hay nada inherentemente malo en la estructura del mercado hoy en día. Sí, se concentra con las 10 acciones principales que representan más del 35% de toda la capitalización del mercado del índice. Sin embargo, esto está siendo impulsado por el crecimiento, y a diferencia de finales de los años 1990 y principios de los 2000, durante el auge de Internet, estas empresas son enormemente rentables y generan flujos de caja significativos. Desde principios de año, el múltiplo de estas acciones como grupo ha disminuido, ya que el crecimiento de las ganancias ha sido más rápido que el nivel de apreciación de los precios. Esto podría limitar el riesgo a la baja, ya que los flujos de efectivo y las ganancias no son especulativos, pero también se podría decir que parece probable que la tasa de crecimiento se desacelere en el futuro. La realidad es que no conocemos todas las implicaciones del impacto de la IA en nuestra economía, negocios y mercados. Puede ser menos de lo que se piensa actualmente, lo que significa que los rendimientos futuros de algunas de las acciones involucradas pueden ser decepcionantes. Por otro lado, podría ser incluso más grande de lo que sabemos, lo que significaría que los precios de hoy pueden parecer una ganga. Qué gran momento para estar vivo.

Obtenga los números entregados en su bandeja de entrada.

Suscríbase (Se abre en una pestaña nueva)