Las posibilidades de un recorte de tasas de la Fed en septiembre ahora son del 100%

El decepcionante informe de empleo de agosto muestra una clara tendencia de crecimiento más lento

El informe mensual de empleo de agosto sorprendió a la baja, ya que el crecimiento del empleo totalizó solo 22,000, y la tasa de desempleo general aumentó a 4.3%. Además, mientras que el número de empleos del mes pasado se revisó ligeramente al alza, el número de empleos para junio se revisó nuevamente a la baja y ahora muestra un crecimiento negativo del empleo para el mes. Hay algunas áreas en las que podemos encontrar consuelo: los ingresos estables indican que la presión salarial sigue siendo moderada y que la tasa de participación en la fuerza laboral ha aumentado. Sin embargo, la tendencia general en el mercado laboral es ahora claramente más lenta.

De alguna manera, ha tomado el mensual Departamento de Trabajo Informe un tiempo para ponerse al día con otros puntos de datos que muestran un crecimiento económico más lento. Ofertas de empleo, según se informa en el Job Openings and Labor Turnover Survey (JOLTS) (Encuesta de ofertas de empleo y rotación laboral), han estado disminuyendo, y este mes mostró poco menos de un trabajo abierto por cada persona desempleada en los EE. UU. Recuerde, mientras nos recuperábamos del cierre económico relacionado con la pandemia, que los empleos abiertos en un momento mostraron dos empleos abiertos por cada persona desempleada. También se puede recordar el caos del mercado laboral en ese momento, ya que otro punto de datos en el informe JOLTS mostró que las personas estaban renunciando a sus trabajos a tasas muy altas a medida que buscaban otras oportunidades y salarios más altos. La "tasa de abandono" dentro de JOLTS es ahora mucho menor. Incluso en los datos semanales de solicitudes de desempleo, hemos visto un entorno en el que las empresas no están despidiendo a muchas personas, pero la contratación se ha desacelerado.

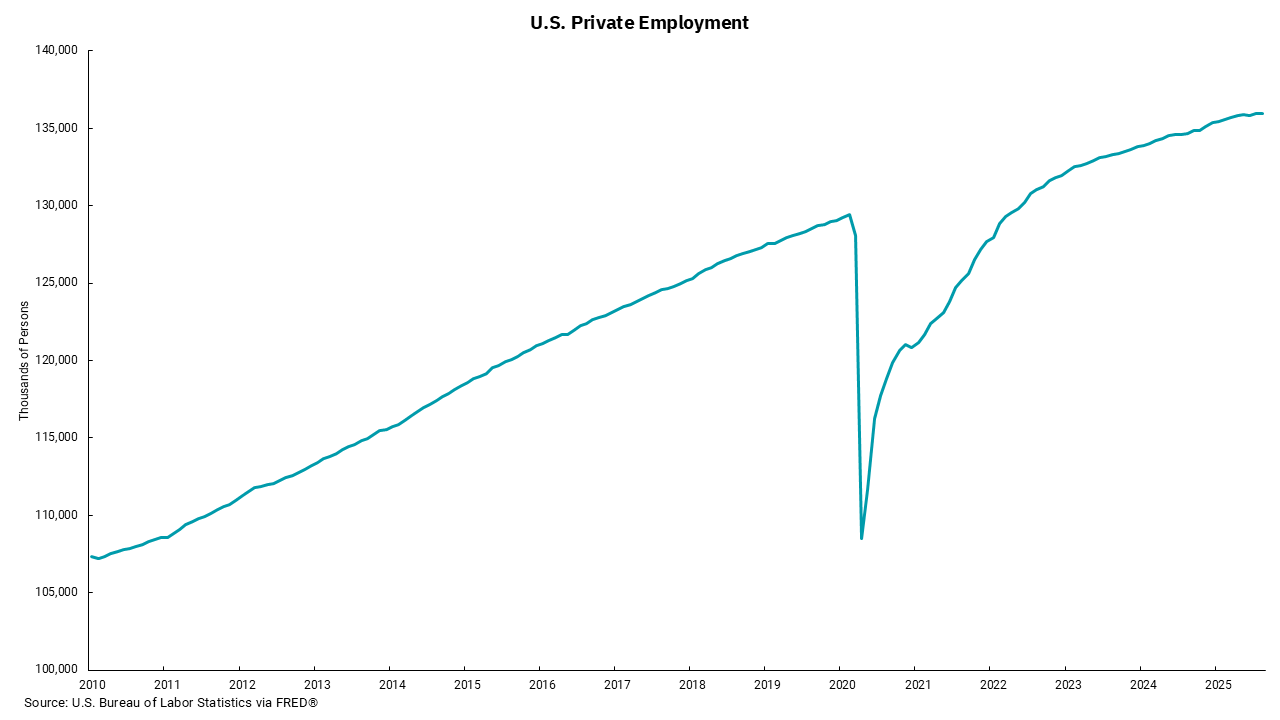

Nuestro gráfico de esta semana muestra el empleo en el sector privado dentro del informe mensual del DOL. Si bien el crecimiento del empleo fue robusto el año pasado y entrará en este año, podemos ver que el crecimiento en el empleo del sector privado ha comenzado a desacelerarse. Sigue siendo positivo, pero crece a un ritmo más lento. También podemos ver que, incluso cuando nos hemos recuperado de la fuerte caída de la pandemia, el crecimiento del empleo en el sector privado no ha recuperado el nivel anterior a la pandemia. Esto no quiere decir que el empleo en el sector público no sea importante, lo es. Sin embargo, a largo plazo, es el crecimiento del sector privado lo que conducirá a un crecimiento más sostenible del empleo en Estados Unidos.

Tras la publicación del informe de empleo, las posibilidades de un recorte de tasas del 0,25% en la reunión de la Fed en dos semanas aumentaron al 100%. Incluso hay una pequeña posibilidad de un recorte del 0,5% (no creemos que ocurra un recorte del 0,5%). Más allá de eso, el mercado ahora está descontando hasta tres recortes de tasas entre ahora y fin de año.

Sobre la base de estos recortes proyectados, los rendimientos de los bonos del Tesoro cayeron, e inicialmente, los precios de las acciones subieron a nuevos récords en los índices nacionales de gran capitalización. Las tasas de interés más bajas pueden ayudar a justificar las valoraciones de las acciones e incluso podrían ayudar a que el mercado de la vivienda vuelva a funcionar, pero debemos tener cuidado con lo que deseamos. Si las tasas están cayendo porque el mercado laboral se está deteriorando, entonces las perspectivas de crecimiento también se moderará. El gasto del consumidor representa dos tercios de la economía de Estados Unidos, y los consumidores sin empleo no pueden gastar casi tanto. En ese caso, las perspectivas para las ganancias de la compañía también podrían comenzar a desacelerarse.

No creemos que una recesión sea inminente, pero entender por qué están bajando las tasas es una parte importante de las medidas que un inversor podría tomar. En resumen, no queremos una Fed que tenga que bajar las tasas agresivamente.

Obtenga los números entregados en su bandeja de entrada.

Suscríbase (Se abre en una pestaña nueva)