Propietarios de pequeñas empresas optimistas para 2026 y 2027

Los cambios fiscales y el entusiasmo por la IA aumentan las esperanzas

Por lo general, obtenemos dos tipos de datos al considerar la dirección y la velocidad del crecimiento económico. Los llamados datos "duros" cubren temas como la inflación y el empleo, mientras que los datos "blandos" tienen como objetivo medir el sentimiento público sobre la inflación, el empleo y las perspectivas comerciales en general. No es inusual que haya momentos, como hemos visto recientemente, en los que la "imagen" de la economía de estas dos fuentes diverge.

Recientemente, a pesar de los datos que muestran un nivel razonable de actividad económica, un producto interno bruto (PIB) positivo y un bajo desempleo, los datos de las encuestas sobre consumidores y empresas fueron decididamente más sombríos. Para algunas encuestas de consumidores, estábamos en niveles más estrechamente asociados con recesiones, no con crecimientos positivos y niveles récord de índices bursátiles. Claramente, a veces las personas "sienten" de manera diferente a lo que los datos económicos podrían reflejar.

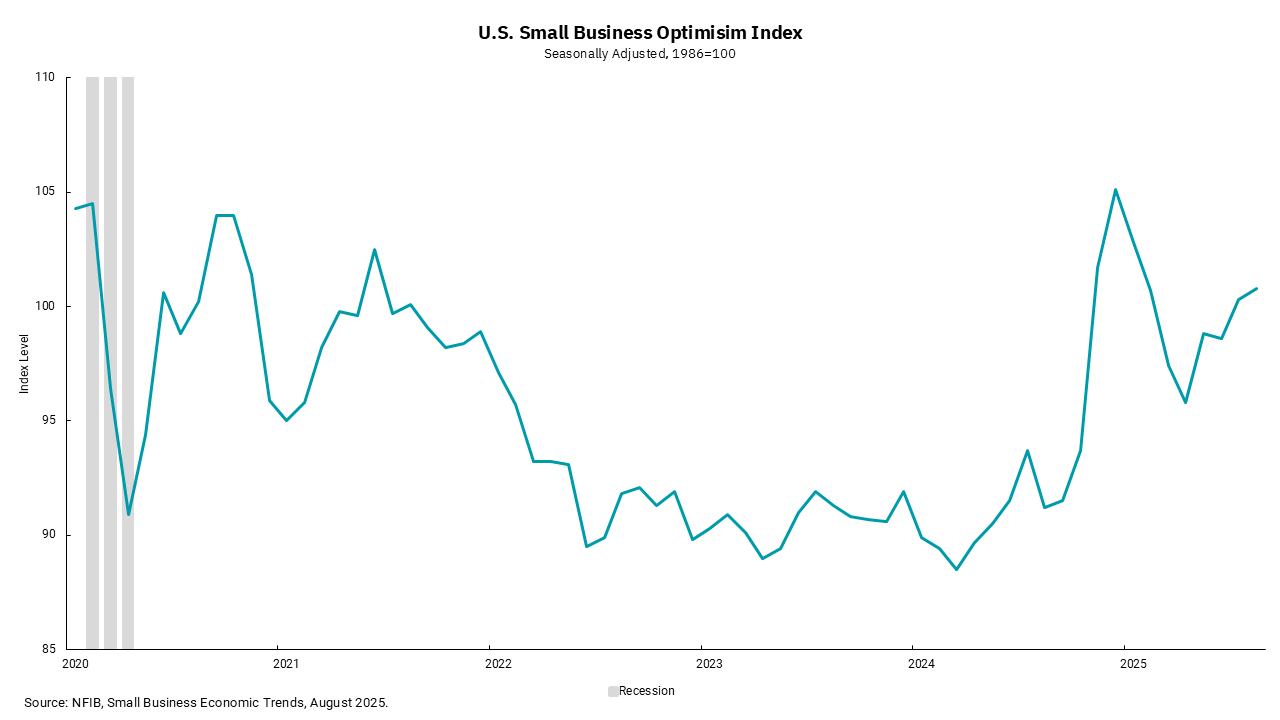

Nuestro gráfico de esta semana sigue el índice de optimismo de las pequeñas empresas. Consideramos que este índice es importante porque las pequeñas empresas son responsables de una parte importante del empleo en los Estados Unidos e impulsan gran parte de la innovación dentro de nuestra economía. Muchas de las compañías más grandes de nuestra economía actual eran pequeñas empresas hace solo un par de décadas, o menos. Llevamos nuestro gráfico al inicio de la pandemia para poder ver el repunte a medida que la economía comenzaba a reabrirse, pero luego EE. UU. entró en un largo período de menor optimismo, incluso cuando la economía en general continuó funcionando. El aumento más alto al final de 2024 se correspondió con las elecciones presidenciales y una creciente sensación de optimismo económico.

Este optimismo, sin embargo, se encontró con la realidad de algunas políticas, como los aranceles, que fueron vistos de manera algo negativa para las perspectivas de crecimiento. (Estamos de acuerdo). Sin embargo, a medida que ha pasado el tiempo y se han reducido los peores escenarios del despliegue de la política arancelaria poco elegante, el optimismo está regresando. La extensión de la Ley de Empleos y Reducción de Impuestos, junto con la adición de algunas acciones de estímulo para los consumidores, ha ayudado a impulsar algunas mejoras en el optimismo del consumidor y un repunte aún mayor en el optimismo de las pequeñas empresas.

Siento esta mejora cuando visito a los dueños de negocios durante mis viajes. Los beneficios adicionales en torno a los gastos frente a la depreciación, y la explosión continua de gasto en inteligencia artificial (IA), hacen que las empresas miren a través de nuestro período actual de crecimiento más lento y piensen en un mejor entorno en 2026 y 2027. Esto también podría ser un factor en por qué parece que las empresas, mientras disminuyen su tasa de contratación, han tardado en reducir materialmente la fuerza laboral. Debido al recuerdo de lo difícil que fue contratar personas en los últimos años, las empresas podrían estar dispuestas a retener a los empleados para asegurarse de que cuentan con personal para una economía que mejora.

Reconocemos los vientos en contra que enfrenta actualmente Estados Unidos, incluida la reciente debilidad del mercado laboral. La inflación controlada, si no está disminuyendo, le dará a la Fed espacio para bajar las tasas hasta cierto punto a partir de esta semana. Las tasas más bajas también pueden aumentar la sensación de optimismo de las pequeñas empresas y ponerlas a ellas, y a nosotros, en una posición para seguir siendo mucho más optimistas que pesimistas mientras pensamos en el avance de la economía.

Obtenga los números entregados en su bandeja de entrada.

Suscríbase (Se abre en una pestaña nueva)