Los cierres no son nuevos, como tampoco lo es la resiliencia del mercado

Una mirada retrospectiva a casi 50 años de cierres muestra que, si bien la política puede estancarse, los mercados tienden a recuperarse y, a menudo, prosperan.

PUNTOS CLAVE

- Los cierres han ocurrido bajo ambos partidos y varias mayorías en el Congreso, lo que demuestra que no están vinculados a un lado político.

- El rendimiento del S&P 500 durante las paradas es mixto, pero los rendimientos de 12 meses después de las paradas son generalmente positivos, con un promedio de más del 12%.

- Se alienta a los inversores a seguir con sus planes financieros a largo plazo en lugar de reaccionar ante eventos políticos a corto plazo.

Ahora que el gobierno de los Estados Unidos está en otro cierre, y este con los riesgos potencialmente más altos de algunos recortes permanentes de empleos federales, la pregunta se ha convertido: "¿Qué debe hacer un inversionista?" Sin ofrecer consejos específicos, ya que la situación de cada persona es diferente, tomemos la historia como una guía potencial.

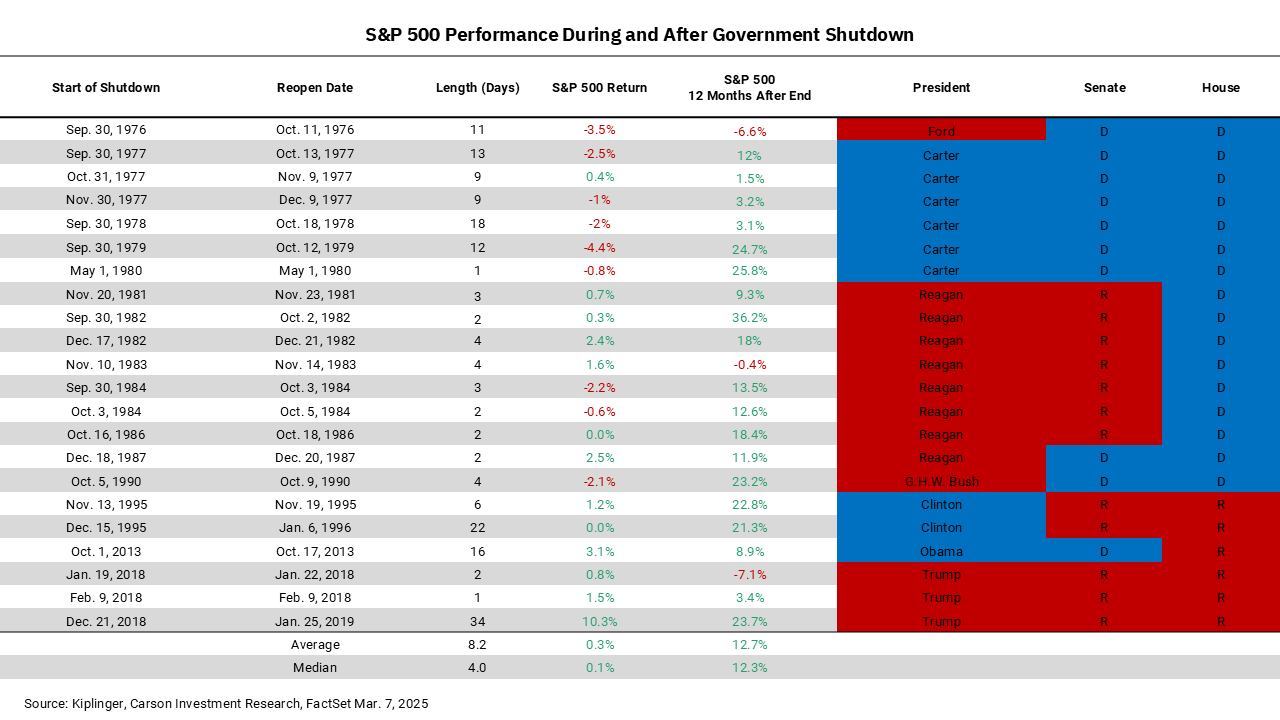

Nuestro gráfico de esta semana muestra las fechas y duraciones de los cierres del gobierno desde el 1976, junto con los nombres de los presidentes y el partido con la mayoría en cada cámara del Congreso. Como podemos ver, los cierres del gobierno parecen ser un evento bipartidista. Han ocurrido bajo presidentes de ambos partidos y con ambos partidos controlando tanto la Cámara de Representantes como el Senado. Este fue uno de los aspectos más interesantes de los datos. Intuitivamente, parecería tener más sentido que tendríamos más desacuerdos que condujeran a un cierre si hubiera un liderazgo mixto entre el Poder Ejecutivo y el Poder Legislativo en Washington. En cambio, el cierre más largo, que duró 34 días, ocurrió durante la primera administración del presidente Trump con el control de ambas cámaras del Congreso. Y no recordaba la frecuencia y duración de los múltiples cierres durante la administración de Jimmy Carter del 1977 al 1980. Y para ser justos, el presidente Reagan, el Gran Comunicador, también tuvo una serie de cierres, aunque tendían a ser más cortos.

Claramente, los cierres del gobierno no son nuevos, ni son el producto de un partido político sobre otro. Lo que también es evidente, si observamos el desempeño del S&P durante, y luego doce meses después del cierre, es que los inversores generalmente no se ven afectados por estas acciones. No es sorprendente que la acción del precio durante el cierre sea más mixta. En un día o semana determinados, la dirección del mercado puede variar. Y cada vez que alargamos los horizontes de inversión, el porcentaje de resultados positivos aumenta, pero solo ha habido tres casos de acciones negativas doce meses después de un cierre del gobierno, con un rendimiento promedio de más del 12%.

Gran parte de esto podría provenir del hecho de que, a pesar de las razones del cierre, la solución normalmente resulta en un mayor gasto público y un crecimiento económico más rápido. ¿Significa esto que un mayor gasto público es la clave para el crecimiento económico? Claro que no. Pero un mayor gasto público se suma al crecimiento medido por el PIB y, al final, a los inversores bursátiles les gusta el crecimiento mucho más que la austeridad.

Entonces, volviendo a la pregunta original, "¿Qué debe hacer un inversor?" Siga con el plan que tiene implementado. ¿Y si no tienes un plan? Hablemos.

Obtenga los números entregados en su bandeja de entrada.

Suscríbase (Se abre en una pestaña nueva)