La niebla de datos de la Reserva Federal y los mercados financieros

El cierre récord del gobierno está creando incertidumbre y pesando sobre la confianza de los inversores

PUNTOS CLAVE

- El cierre del gobierno ha limitado el acceso a datos económicos críticos, lo que obliga a depender de las estimaciones.

- La disminución de las tasas de respuesta de las encuestas está aumentando el riesgo de revisiones importantes en informes clave como el empleo y la inflación.

- Los datos inexactos o incompletos podrían dar lugar a decisiones equivocadas de política monetaria y a la volatilidad del mercado.

Tras la reciente reunión del brazo de fijación de tasas de interés de la Reserva Federal, el Comité Federal de Mercado Abierto (FOMC), el presidente Jay Powell comparó el entorno para tomar decisiones con "conducir en una niebla". El cierre del gobierno ha resultado en una escasez de datos económicos que el FOMC y los participantes del mercado normalmente usarían para discernir qué podría / debería hacerse cuando se trata de política monetaria. Todavía tenemos una serie de informes privados y relacionados con la industria para ver, pero no estamos obteniendo el mismo nivel de información que necesitamos.

Sin embargo, más allá de la falta de datos gubernamentales, se ha producido un cambio más profundo, lo que puede significar que los datos que normalmente recibimos no son tan precisos como lo fueron en el pasado. De hecho, el reciente Informe del Índice de Precios al Consumidor (IPC), que se retrasó pero fue necesario ya que la medida de inflación de este mes se utilizó para ayudar a establecer el ajuste anual por costo de vida para los beneficiarios del Seguro Social, tenía alrededor del 40% de los datos imputados. Es decir, las estadísticas reales no estaban disponibles, por lo que las estimaciones, también se podría decir conjeturas pero conjeturas educadas, se utilizaron para llegar a un número final. Como resultado, los beneficiarios del Seguro Social obtendrán un ajuste por costo de vida (COLA) del 2.8% para 2026. Como anécdota, no conozco a muchas personas mayores que piensen que un COLA del 2.8% se mantendrá al día con sus aumentos reales en sus presupuestos.

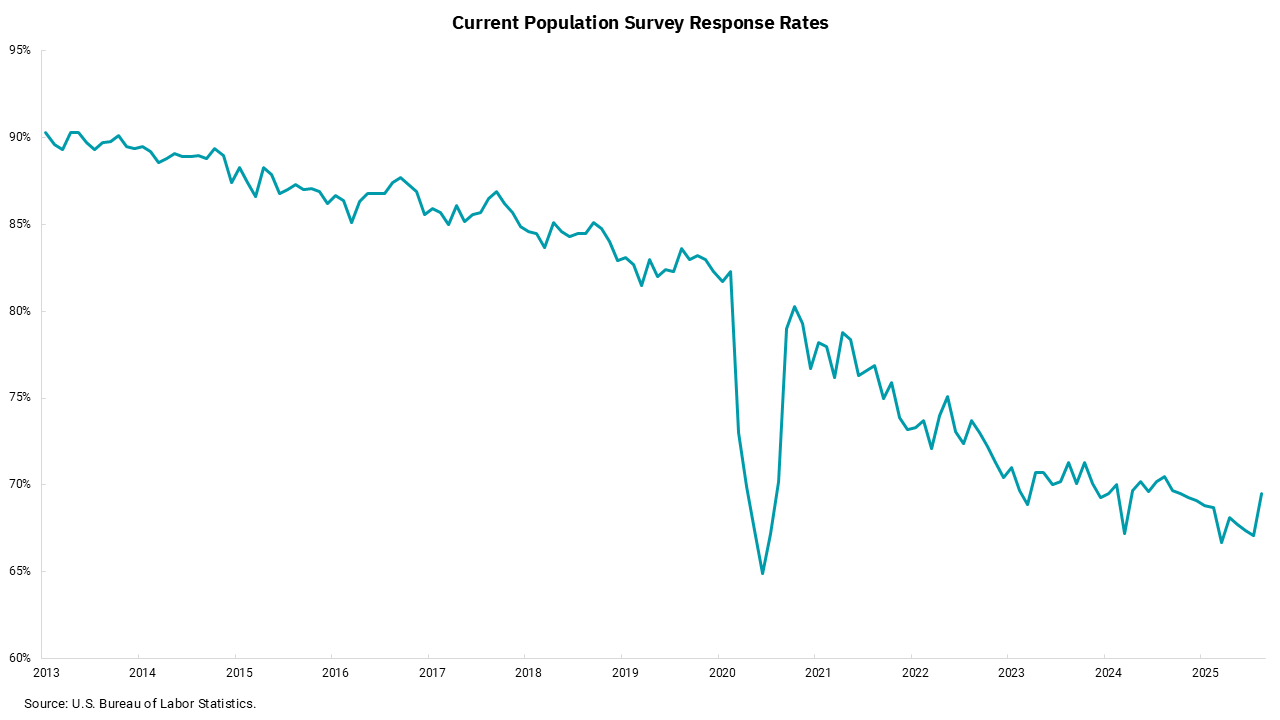

En cuanto a los datos en general, hemos estado viendo una tendencia en las tasas de respuesta que se mueven a la baja. Muchas estadísticas gubernamentales incluyen al menos un componente de la información de la encuesta, donde se contacta a las personas o empresas y se les pide que respondan con información que luego se utiliza para compilar informes. Al igual que con cualquier conjunto de datos, cuanto mayor sea el número de entradas, mayor será la precisión, o mejor dicho, menor será el error estándar. En términos simples, un tamaño de muestra más pequeño significa una mayor probabilidad de un gran aumento de la revisión.

Nuestro gráfico de esta semana muestra la tasa de respuesta para las encuestas de población, pero se puede ver una tendencia similar en todo el espectro de la encuesta. Las implicaciones son que el dinero se está moviendo, y que los mercados son más altos o más bajos en función de esos datos, sin embargo, podría resultar materialmente diferente después de la primera mirada. Una reciente revisión anual sobre el crecimiento de nuevos empleos mostró unos 900,000 empleos menos de lo que se informó inicialmente. El informe mensual de empleo es una de las medidas mensuales más importantes que obtenemos sobre la economía y juega un papel muy importante en las decisiones de política monetaria, y sin embargo, las disminuciones en los índices de respuesta han llevado a grandes revisiones cada uno de los últimos dos años. Puede ser que se justifique una revisión de cómo recopilamos datos, ya que los tamaños de muestra más pequeños son menos precisos.

Obtenga los números entregados en su bandeja de entrada.

Suscríbase (Se abre en una pestaña nueva)