La asequibilidad de la vivienda: una "batalla de mercado local"

Ni las hipotecas a 50 años ni declarar una emergencia nacional resolverían el problema

PUNTOS CLAVE

- La asequibilidad de la vivienda está por debajo del umbral de ingresos del 30%, lo que indica un entorno de mercado desafiante.

- La oferta limitada de viviendas y las tasas hipotecarias elevadas son los principales impulsores de las restricciones de asequibilidad.

- Las posibles soluciones, como las hipotecas a 50 años y los cambios regulatorios, solo ofrecerían un alivio limitado sin cambios más amplios en el mercado.

Un nuevo término es cada vez más frecuente al describir las dificultades que muchos enfrentan en la economía actual: asequibilidad. Este término abarca muchos aspectos de cómo se sienten los consumidores acerca de su situación actual. Algunos datos indicarían que la inflación está disminuyendo, mientras que los consumidores ven muchas áreas de sus propios presupuestos tensas con aumentos de precios descomunales en áreas como los seguros y la atención médica. Para muchos, la sensación es que el costo de vida en general está aumentando más rápido que la lectura más reciente sobre el núcleo Consumer Price Index (CPI - Índice de Precios al Consumidor) al 3%.

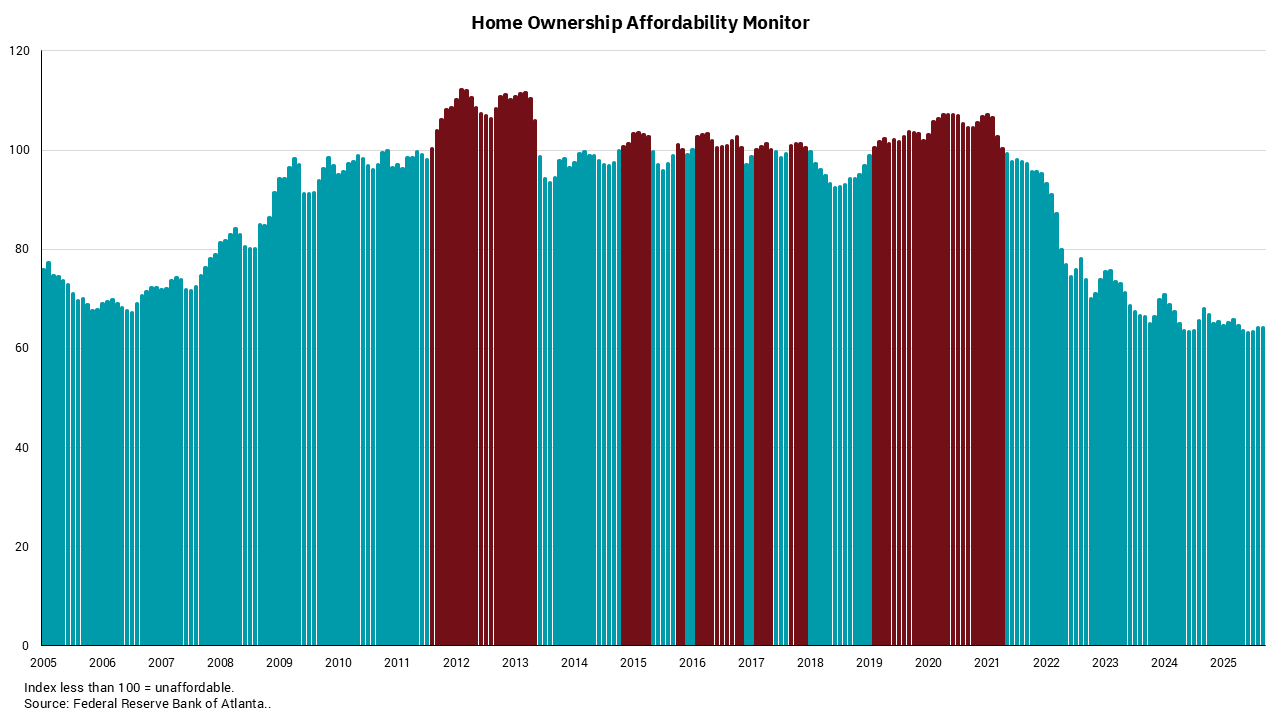

Un área donde la asequibilidad se ha medido durante mucho tiempo es en la industria de la vivienda. Nuestro gráfico de esta semana muestra que la asequibilidad de la vivienda vuelve a 2005. A los efectos de este índice, el punto de ruptura de la asequibilidad es cuando el costo total de propiedad excede el 30% del ingreso familiar medio anual. Este costo total de propiedad incluye el capital y los intereses mensuales, así como los impuestos y el seguro sobre el precio medio de una vivienda a nivel nacional. Obviamente, este índice será diferente para diferentes lugares, pero mirar los datos agregados puede darnos una visión importante del mercado inmobiliario en general.

La vista, en la actualidad, muestra que estamos en un entorno de asequibilidad difícil, como es evidente en el gráfico de esta semana. En él, las barras rojas indican períodos en los que el costo total de propiedad fue inferior al 30%, lo que significa que la asequibilidad fue positiva. Las barras azules debajo de la línea son cuando el costo total de propiedad superó el 30% y la asequibilidad fue baja. El nivel general de construcción de viviendas desde la crisis financiera ha quedado rezagado con respecto al número requerido de viviendas nuevas en función de la población en alrededor de cuatro a cinco millones de unidades. Esto significa que la oferta general es limitada, que es un factor en los niveles de precios más altos.

Además del costo del seguro y los niveles impositivos generales, el mercado inmobiliario actual enfrenta una combinación de tasas hipotecarias más altas y precios más altos. Cuando se combinan, es fácil ver por qué la asequibilidad es tan limitada. En estos niveles, el camino de regreso a la asequibilidad requerirá cambios significativos en múltiples variables. Necesitaríamos ver una combinación de ingresos más altos, precios más bajos, tasas más bajas y costos reducidos de seguros e impuestos. En un entorno con restricciones de suministro, esto podría ser difícil de lograr.

La administración anunció recientemente la idea de hipotecas a 50 años, junto con la posibilidad de declarar una emergencia nacional de vivienda para reducir la carga regulatoria federal. Ninguna de esas ideas resolvería completamente la situación actual. La mayoría de las regulaciones de vivienda se establecen a nivel estatal y local, en lugar de a nivel nacional. Si bien extender la fecha de vencimiento de una hipoteca puede reducir la parte principal de un pago mensual, las tasas más altas y una acumulación de capital más lenta podrían compensar cualquier ventaja de extender. Hay varios esfuerzos en marcha para aumentar la oferta de viviendas asequibles, pero esto va a ser una batalla de mercado local en muchos frentes.

Obtenga los números entregados en su bandeja de entrada.

Suscríbase (Se abre en una pestaña nueva)