Por qué es probable que la Fed reduzca las tasas esta semana

El debilitamiento del mercado laboral eclipsa la inflación pegajosa

PUNTOS CLAVE

- El doble mandato de la Fed apunta al pleno empleo y la estabilidad de precios, con un objetivo de inflación del 2% que guía la política.

- Los recientes recortes de tasas sugieren una creciente preocupación por los riesgos para el empleo a pesar de que la inflación se mantiene por encima de la meta.

- El contexto histórico muestra definiciones cambiantes de "pleno empleo", lo que agrega complejidad a las decisiones actuales de la Fed.

Como muchos de ustedes saben, la Reserva Federal tiene un doble mandato: pleno empleo y estabilidad de precios. La definición de "pleno empleo", de acuerdo con lo que está disponible en www.federalreserve.gov, es "el nivel más alto de empleo o el nivel más bajo de desempleo que la economía puede sostener en un contexto de estabilidad de precios". No veo números en esa definición. En cuanto a la estabilidad de precios, el mismo sitio web afirma: "Los precios se consideran estables cuando los consumidores y las empresas no tienen que preocuparse por los costos que aumentan o disminuyen significativamente al hacer planes o pedir dinero prestado durante largos períodos". El Comité Federal de Mercado Abierto (FOMC) considera que una tasa de inflación del 2% a largo plazo, medida por el cambio anual en el Gastos de Consumo Personal (ECF) El índice de precios es más consistente con el mandato de estabilidad de precios de la Fed. ¡Vaya! Al menos tenemos un número aquí, 2%.

A veces, ambos mandatos piden que se actúe en la misma dirección. Si la economía se está calentando, lo que lleva a mercados laborales ajustados que se reflejan en el aumento de las presiones salariales y una mayor inflación, el curso de acción de la Reserva Federal hacia tasas más altas es claro. Por el contrario, si el desempleo está aumentando y la inflación está cayendo a medida que disminuye la demanda, la necesidad de tasas más bajas de la Reserva Federal es obvia. A veces, sin embargo, la Fed está tratando de decidir qué mandato es más importante y el camino a seguir no está exento de riesgos. Tal es el caso hoy

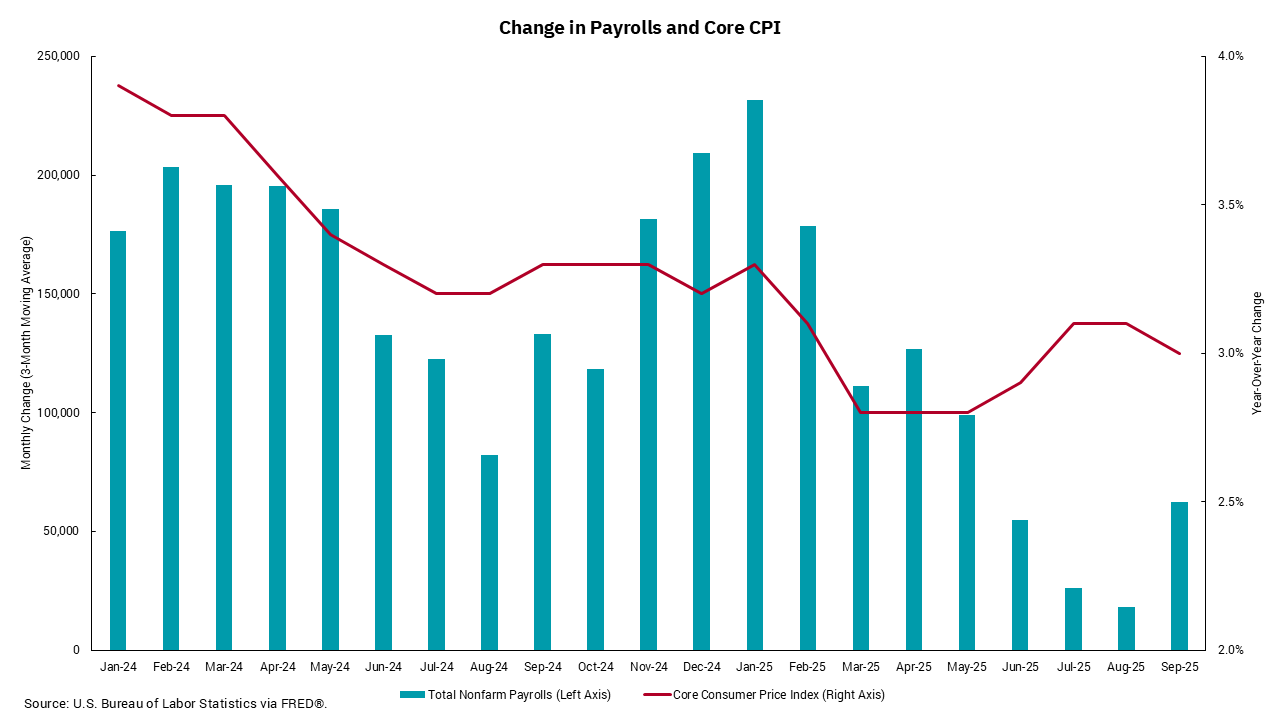

Nuestro gráfico de esta semana muestra la tasa anual de inflación, medida por el "núcleo" Índice de Precios al Consumidor (IPC), que excluye la volatilidad de los precios de los alimentos y la energía, frente al cambio mensual en las nóminas desde el 2024 de enero. Durante este período, la Fed ha reducido la tasa objetivo de los fondos federales a un día en 150 puntos básicos, o 1.5%, de un rango objetivo de 5.25-5.50% al rango actual de 3.75% -4%. Gran parte de esta reducción ha sido liderada por la disminución de la inflación del 4% a la lectura más reciente del 3%. La necesidad de reducir las tasas debido a la parte del mandato de "pleno empleo" fue menos apremiante, ya que el crecimiento del nuevo empleo se mantuvo positivo y la tasa de desempleo se ha mantenido estable en torno al 4,2%.

Los comentarios y acciones recientes de la Fed sugieren un cambio en el enfoque de la inflación al empleo. La inflación subyacente, aunque más baja en septiembre que en agosto, sigue siendo más alta que hace algunos meses. Como resultado, los recientes recortes de tasas parecen estar impulsados más por los riesgos de una desaceleración del mercado laboral que por el progreso continuo hacia el objetivo de la Fed de una inflación del 2%. (Uno podría preguntarse razonablemente por qué la estabilidad de precios significa una inflación del 2%, en lugar de algo más estable, como el 0%, pero estoy divagando). En el pasado, hemos visto que la tasa de desempleo aumenta rápidamente una vez que comienza a subir, por lo que se justifica cierta medida de precaución por parte de la Reserva Federal. Por otra parte, recuerdo una época en la que se pensaba que el "pleno empleo" era una tasa de desempleo del 5%. Parecería que el "pleno empleo" podría ser una tasa de desempleo ligeramente más baja ahora. En resumen, busque otro recorte de tasas de la Fed esta semana.

Obtenga los números entregados en su bandeja de entrada.

Suscríbase (Se abre en una pestaña nueva)