El recorte de tasas de la Reserva Federal indica un crecimiento más amplio en el futuro

Se espera que las ganancias se amplíen más allá de las acciones impulsadas por la IA

PUNTOS CLAVE

- El último recorte de tasas de la Fed refleja las preocupaciones sobre la debilidad del mercado laboral y la inflación, preparando el escenario para cambios graduales de política en 2026.

- El optimismo del mercado está impulsado por los pronósticos de un crecimiento más amplio de las ganancias más allá de la Mag 7 y en acciones de pequeña capitalización el próximo año.

- Un enfoque de inversión diversificado sigue siendo clave a medida que la aceleración económica y la rotación del sector remodelan la dinámica del mercado en 2026.

El brazo de fijación de tasas de interés de la Reserva Federal, el Comité Federal de Mercado Abierto (FOMC), se reunió la semana pasada y decidió reducir las tasas de interés en otro 0,25%. Fue la tercera reunión consecutiva en la que se tomó la decisión de recortar las tasas. Sin embargo, como ha sido el caso recientemente, hubo múltiples disidencias a la acción: dos disidencias estaban a favor de ningún recorte de tasas, y una estaba a favor de un recorte del 0.5%. Cada vez está más claro que el rango de opiniones entre los miembros del FOMC es más amplio que en los últimos períodos, mientras que el mandato del presidente de la Fed, Jay Powell, como presidente de la Fed está llegando a su fin. Esto parece estar permitiendo un entorno donde las opiniones diferentes se expresan más cómodamente.

La principal motivación para el recorte fue la sensación de que el mercado laboral se ha debilitado en los últimos meses y que el desempleo podría subir, lo que pondría en riesgo al consumidor estadounidense desde el punto de vista del crecimiento económico general. Al mismo tiempo, la inflación se mantiene por encima del objetivo de la Fed, lo que lleva a algunos miembros del FOMC a preocuparse por bajar demasiado las tasas y ralentizar, o incluso detener, el progreso hacia el objetivo de inflación del 2% de la Fed. Además, en comentarios posteriores a la reunión, la Fed reconoció el estrés continuo sobre los consumidores de bajos ingresos por la inflación agregada en los últimos años. El término ampliamente utilizado en la prensa es "asequibilidad".

La reacción de los mercados fue ampliamente positiva. Las tasas a corto plazo cayeron más que las tasas a largo plazo a medida que la curva de rendimiento se empinó aún más, mientras que los mercados bursátiles vieron ganancias de precios. Nuestra perspectiva es de recortes limitados de cara al próximo año, por lo que el mercado de bonos podría estar un poco más estable después de ver rendimientos totales positivos de base amplia este año. Para los mercados de valores, hay un par de factores que nos llevan a mantenernos optimistas y a mantenernos diversificados en nuestro enfoque.

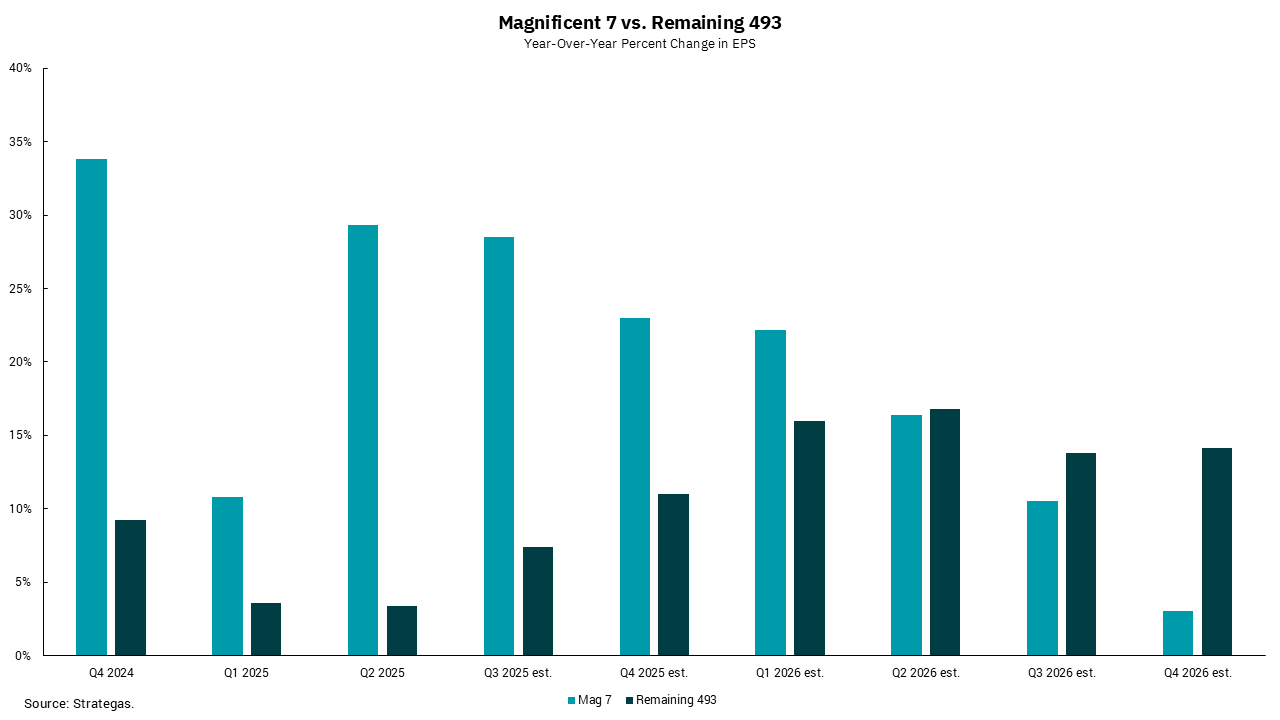

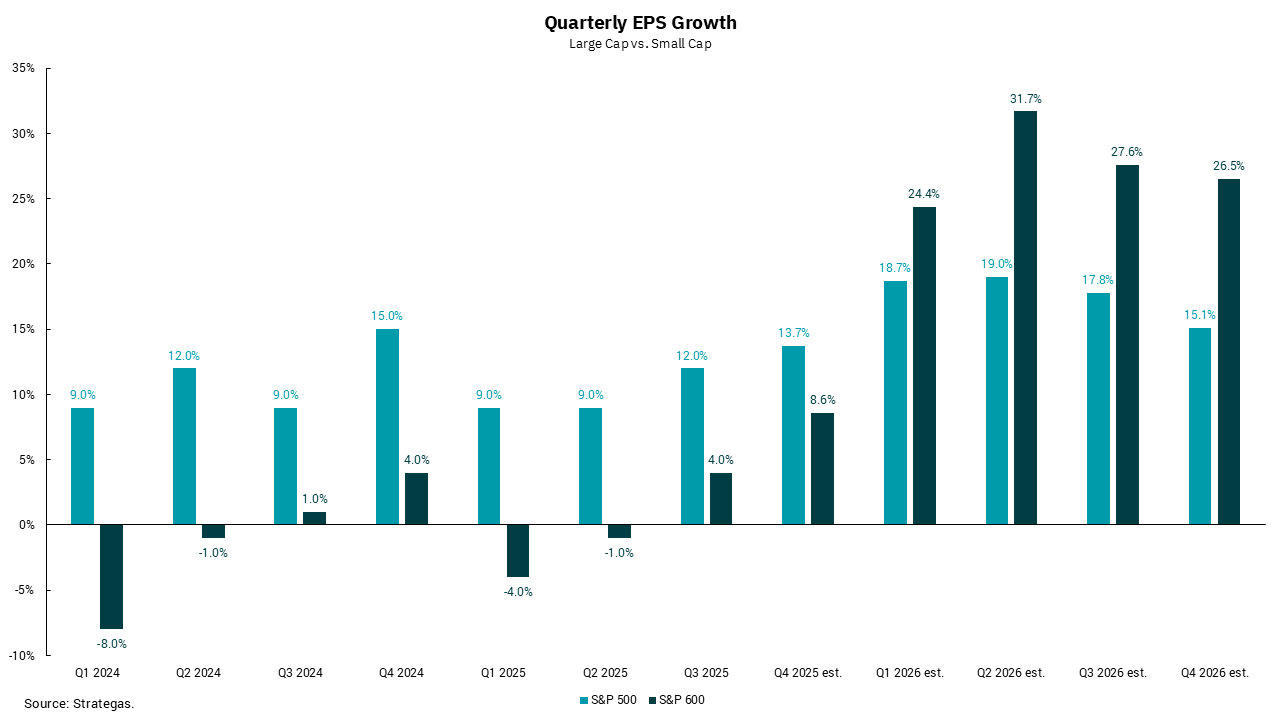

El gráfico superior muestra una mirada a las estimaciones de ganancias para el Mag 7 frente al S&P "493" (las acciones no Mag 7 en el S&P 500), mientras que el gráfico inferior analiza las estimaciones de crecimiento de ganancias para acciones de pequeña capitalización (S&P 600) versus gran capitalización (S&P 500). En ambos casos, estamos viendo un cambio de lo que ha impulsado el mercado en los últimos trimestres. Dentro del espacio de gran capitalización, anticipamos que el crecimiento de las ganancias para el S&P 493 superará al del Mag 7 para el segundo trimestre de 2026. En cuanto a la pequeña capitalización frente a la gran capitalización, anticipamos que las ganancias de pequeña capitalización superarán las ganancias de gran capitalización a partir del primer trimestre de 2026.

Ambos factores reflejan una economía que se espera que se acelere el próximo año y se amplíe para incluir algo más que el rendimiento de las acciones impulsadas por la IA de 2025. Esto no significa que el comercio de IA haya terminado; Simplemente significa que las tasas de crecimiento de esas compañías se desacelerarán, y a medida que la economía se amplíe, otros sectores y capitalizaciones de mercado participarán. Seguimos comprometidos con nuestro enfoque diversificado para la construcción de carteras de renta variable.

Obtenga los números entregados en su bandeja de entrada.

Suscríbase (Se abre en una pestaña nueva)