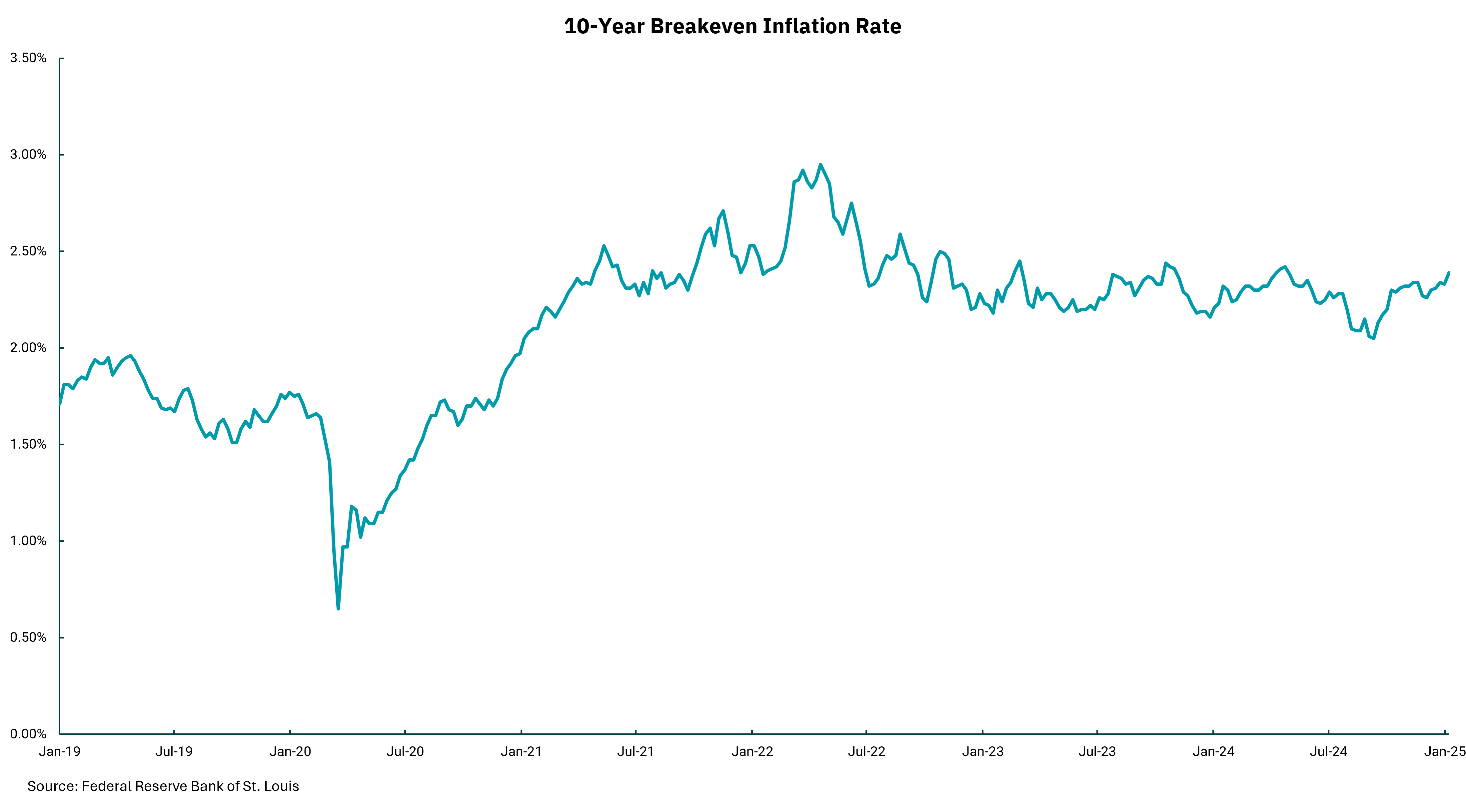

Aumentan las expectativas de inflación a 10 años

Las tasas de interés de la deuda a largo plazo, incluidas las hipotecas, suben

Los mercados de acciones y bonos tuvieron un pequeño respiro esta semana, ya que las medidas de inflación fueron un poco más suaves de lo esperado. Desde que la Reserva Federal comenzó a reducir el objetivo de los fondos federales a un día el 2024 de septiembre, las tasas a largo plazo han estado flotando un poco más altas. Hasta la fecha, mientras que el objetivo de los fondos federales se ha reducido en un 1%, las notas del tesoro a 10 años han aumentado en una cantidad casi idéntica del 1%.

Esta combinación de movimientos en el extremo corto y largo de la curva de rendimiento ha dado lugar a la no inversión de las tasas a una curva de rendimiento de forma más "normal". Sin embargo, las tasas largas que suben mientras la Fed reduce las tasas a corto plazo no es un camino "normal" para los movimientos de tasas, y se han planteado algunas preguntas sobre por qué está sucediendo esto.

Sabemos que el extremo corto de la curva es donde la Fed tiene la influencia más directa sobre las tasas, por lo que el movimiento a la baja en los bonos del Tesoro a corto plazo, con vencimientos de aproximadamente dos años, es esperado y se ha producido. Sin embargo, el extremo más largo de la curva de rendimiento está influenciado por varios factores, como las expectativas de inflación, las expectativas de crecimiento, la política fiscal y el nivel de incertidumbre en torno a cualquiera o todos estos factores.

Esta semana, analizamos las expectativas de inflación como una posible razón. La Reserva Federal a menudo cita las expectativas de inflación de las encuestas de opinión de los consumidores y las empresas al considerar la estabilidad de la inflación futura. En este frente, hemos visto recientes movimientos al alza en las expectativas de inflación relacionadas con el sentimiento. Sin embargo, nuestro gráfico de esta semana analiza una medida basada en el mercado de la inflación futura, la tasa de equilibrio exigida por los inversores en valores protegidos contra la inflación (TIPS) a 10 años.

El gráfico revela que las expectativas de inflación son variables, con una gran caída durante la pandemia seguida de un gran aumento a medida que la inflación se disparó en 2022 y 2023. Sin embargo, recordando que el Índice de Precios al Consumidor (IPC) alcanzó un máximo de poco más del 9%, también podemos ver que las expectativas de inflación alcanzaron un máximo de solo alrededor del 3%. Por lo tanto, incluso en el peor de la inflación, los inversores tenían cierto nivel de confianza en que, en los próximos 10 años, la inflación promediaría mucho más baja. Esta medida de "confianza" es la razón por la que la Reserva Federal presta tanta atención a las expectativas de inflación. Y, entonces, al mirar la parte de extrema derecha del gráfico y vemos un aumento en las expectativas de inflación a medida que la Fed está bajando las tasas, merece cierto nivel de preocupación. También podemos ver que las expectativas de inflación no han subido tanto como el Tesoro a 10 años, por lo que hay otros factores en juego. Sin embargo, un movimiento al alza en las expectativas de inflación no es un desarrollo bienvenido.

Obtenga los números entregados en su bandeja de entrada.

Suscríbase (Se abre en una pestaña nueva)