Se intensifica el debate sobre la reducción de tasas de la Fed

Continúan las perspectivas económicas mixtas, pero es probable un crecimiento más lento

El debate sobre los recortes de tasas continúa. En julio, el Comité Federal de Mercado Abierto (FOMC) decidió mantener las tasas iguales, pero dos miembros discreparon a favor de tasas más bajas. Su disidencia ha añadido un elemento de debate más público a una perspectiva económica ya mixta. Internamente, tenemos un conjunto variado de opiniones, y en este punto, cualquier decisión que se tome será aclamada por algunos y ridiculizada por otros.

Siempre hay espacio para el debate cuando se considera la política monetaria -y fiscal, para el caso-. El doble mandato de la Reserva Federal, pleno empleo y estabilidad de precios, a menudo puede dar señales contradictorias, y tal es el caso hoy. Incluso hay espacio para el debate dentro de cada uno de los dos pilares de su mandato. La inflación está por debajo del objetivo actual de los Fondos Federales, y los impactos de los aranceles han sido más limitados de lo esperado. Sin embargo, el hecho es que la inflación subyacente del Índice de Precios al Consumidor (IPC) sigue siendo superior al 3% y el progreso hacia el objetivo del 2% se ha ralentizado. Los datos recientes del Índice de Precios al Productor (IPP), junto con encuestas de gerentes de compras y gerentes de suministros, muestran que las presiones inflacionarias pueden estar aumentando dentro de la economía en general. En general, me atrevo a decir que las presiones arancelarias sobre los precios son transitorias, pero parece que todavía tenemos ante nosotros cierto nivel de aumento de los índices de inflación.

Los datos del mercado laboral muestran una tasa de desempleo general del 4,2%, y las solicitudes semanales de desempleo continúan reflejando un entorno en el que las empresas parecen dudar en reducir el número de empleados. Al mismo tiempo, los datos dentro de la Encuesta de Apertura de Empleo y Rotación Laboral (JOLTS) y las reclamaciones continuas también confirman que la tasa de contratación se ha desacelerado. Las tasas de desempleo de graduados universitarios recientes son elevadas.

Dentro de cada uno de estos dos mandatos, se puede construir un caso creíble para tasas estables o más bajas. Pocos economistas en este momento pronostican una recesión absoluta, pero es evidente un período de crecimiento más lento. Un crecimiento más lento y una inflación pegajosa tienen una sensación de "estanflación".

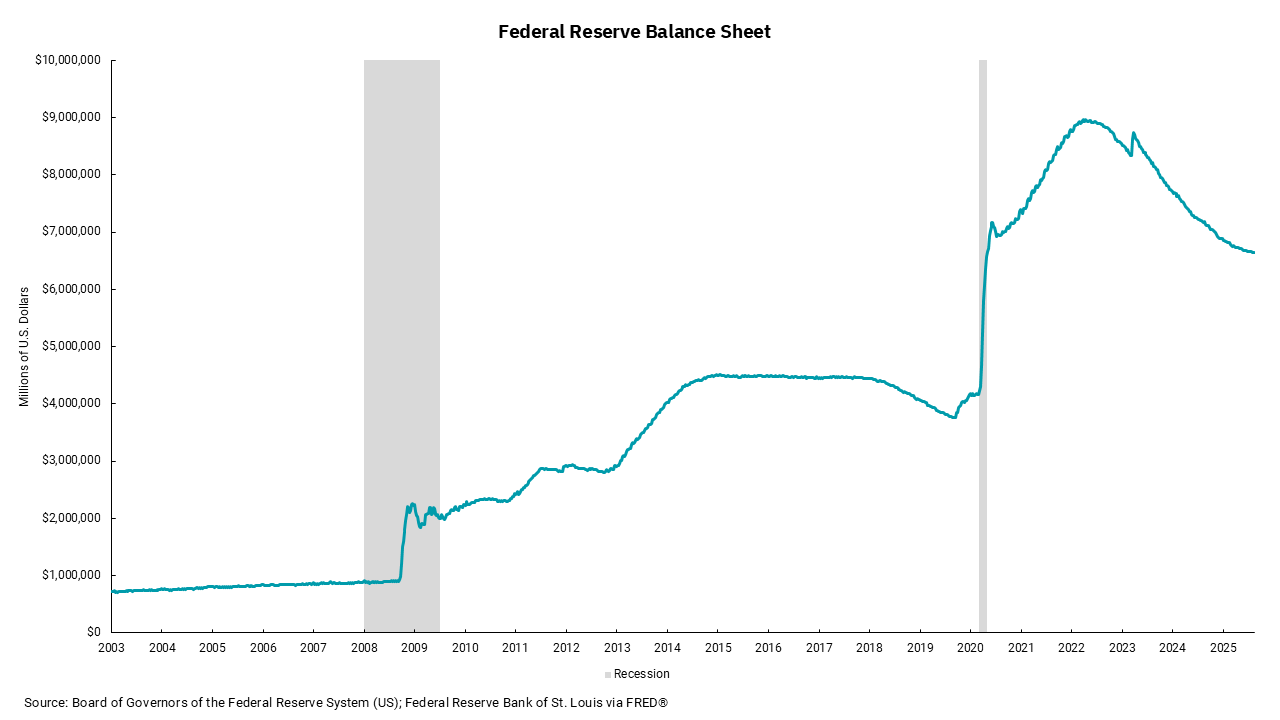

El otro aspecto de la postura actual de la política monetaria de la Fed, que no está recibiendo tanta atención como las tasas, es su política continua para reducir el tamaño de su balance, conocida como ajuste cuantitativo. Esta parte de la política monetaria no tiene el impacto inmediato o visible como las decisiones sobre tasas. Aún así, puede ser tan importante como pensamos en los mercados de capitales e incluso en las tasas de consumo como las hipotecas de viviendas. Desde que la Reserva Federal comenzó a reducir el tamaño de sus tenencias hipotecarias, los diferenciales generales de los préstamos hipotecarios se han ampliado, lo que ha llevado a tasas de endeudamiento algo más altas para los posibles propietarios de viviendas. También importa en qué parte de la curva de rendimiento está activa la Fed. A medida que los préstamos del Tesoro se calientan en función del reciente aumento del techo de deuda y la necesidad de rellenar la Cuenta General del Tesoro (TGA), la Fed podría influir en función de su decisión sobre cómo reinvertir los vencimientos y los pagos de intereses. En resumen, se trata de gestionar el equilibrio entre la oferta y la demanda entre el emisor, el Tesoro de los Estados Unidos y los inversores. Un desajuste podría dar lugar a desequilibrios del mercado que podrían ser perjudiciales en múltiples sectores de los mercados de capitales.

El discurso del presidente de la Fed, Powell, el viernes podría tener algunas implicaciones a largo plazo basadas en cómo comunica lo que piensa la Fed. Por otra parte, este es su último discurso en este evento como presidente de la Fed, y no podemos ignorar que los futuros presidentes de la Fed podrían pensar de manera diferente sobre el camino en el que deberíamos estar.

Obtenga los números entregados en su bandeja de entrada.

Suscríbase (Se abre en una pestaña nueva)