Lo que sabemos (y lo que no sabemos) sobre el mercado laboral

El cierre del gobierno ha retrasado la publicación de algunos datos importantes

PUNTOS CLAVE

- El cierre del gobierno ha detenido la publicación de algunos datos económicos, incluido el informe de empleos de septiembre.

- Las tendencias del mercado laboral están influyendo cada vez más en las políticas de la Reserva Federal, con recortes de tasas probables a pesar de la inflación persistente.

- Los datos laborales recientes, incluidos los informes JOLTS y ADP, indican un panorama de empleo que se enfría, lo que genera preocupaciones sobre el impulso económico futuro.

El cierre del gobierno está afectando a muchas personas, y esperamos poder encontrar una solución rápidamente. Más allá de los empleos de las personas, no estamos obteniendo varios puntos de datos clave, incluida la que probablemente sea la información más importante dentro de nuestra economía en la actualidad: el informe mensual de empleos de septiembre.

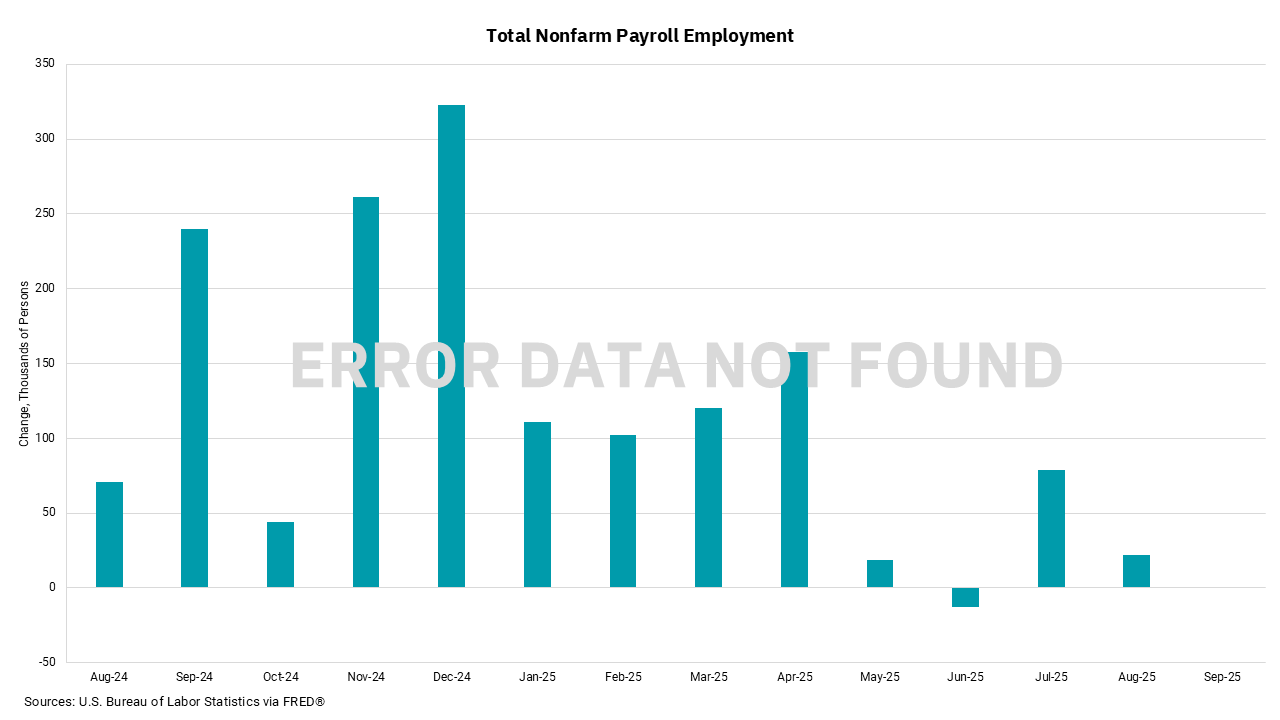

La Reserva Federal indicó que El aumento de los riesgos a la baja para el mercado laboral fue la razón principal por la que bajaron las tasas en su última reunión, a pesar de que la inflación se mantuvo por encima de la meta. Este cambio de enfoque del mandato de inflación al mandato laboral solo aumentó la importancia de los datos que normalmente recibimos sobre el mercado laboral. Los datos recientes que muestran una desaceleración del ritmo de crecimiento del empleo, evidente en nuestro gráfico incluso sin un informe este mes, junto con una enorme revisión a la baja de los nuevos empleos en los últimos 12 meses, han hecho que los mercados se basen principalmente en datos relacionados con el empleo mientras intentamos determinar las acciones futuras de la Fed.

Eso no quiere decir que no obtuvimos ningún dato relacionado con el trabajo esta semana. La Job Openings and Labor Turnover Survey (JOLTS) (Encuesta de ofertas de empleo y rotación laboral) Los datos del martes mostraron una continuación de las tendencias recientes del mercado laboral, ya que las ofertas de empleo se mantuvieron moderadas, mientras que el número de desempleados superó el total de ofertas de empleo. Este es un gran cambio con respecto a principios de la pandemia, cuando alcanzamos un nivel de dos empleos abiertos por cada persona desempleada. Luego, el miércoles, recibimos un informe de ADP en el mercado laboral del sector privado mostrando la primera disminución absoluta en el empleo desde 2023. Para ser justos, los datos de JOLTS no son "malos", ya que los números siguen siendo mejores que el promedio a largo plazo. Además, la correlación entre el informe ADP y el informe mensual de empleos ha disminuido en los últimos años. Todo esto significa que nos quedamos con información imperfecta e incompleta.

Nuestra sensación es que, en ausencia de datos que muestren una marcada mejora en el empleo, que no estamos obteniendo, la Fed está lista para bajar las tasas nuevamente en su reunión de finales de octubre. Es difícil decir que una tasa de desempleo del 4,3% y un crecimiento positivo del producto interno bruto (PIB), del 3,8% en el segundo trimestre y una reciente lectura del modelo GDPNow de la Fed de Atlanta del 3,8% para el tercer trimestre, significa que la Fed necesita ser agresiva o directamente acomodaticia en su política. Sin embargo, no queremos que comience a acelerarse una tendencia negativa en el mercado laboral. Nuestras opiniones sobre las perspectivas positivas de crecimiento en 2026 y 2027 ayudan a disminuir aún más este riesgo, pero cierta reducción en la naturaleza restrictiva de las tasas de interés sigue siendo un resultado de política aceptable.

Obtenga los números entregados en su bandeja de entrada.

Suscríbase (Se abre en una pestaña nueva)