¿Está Estados Unidos liderando la danza de la desglobalización?

Los aranceles son tanto un efecto como un catalizador de la cambiante economía mundial

Este artículo forma parte de nuestra próxima Perspectiva anual de los 2026 mercados. Pulse aquí para visitar nuestra página web de Outlook y registrarse para la discusión en vivo, que se llevará a cabo el 15 y 2026 de enero a las 11 am CT.

PUNTOS CLAVE

- Para Estados Unidos, los aranceles se han convertido tanto en una fuente de ingresos como en una herramienta estratégica para atraer inversión extranjera e impulsar la fabricación nacional.

- La incertidumbre en torno a las estructuras arancelarias creó volatilidad en los mercados mundiales, pero desde entonces se han descontado los peores escenarios.

- El avance hacia la regionalización y la resiliencia de las cadenas de suministro marca un cambio a largo plazo de la eficiencia a la seguridad en el comercio mundial.

A medida que Estados Unidos trabaja para reposicionarse en el escenario mundial a través de aranceles e incentivos fiscales, los efectos dominó han estado reverberando en los mercados globales. A medida que las naciones se recalibran, están surgiendo nuevos acuerdos comerciales y marcos regulatorios, lo que indica un cambio hacia la regionalización y la búsqueda de amigos en lugar de una economía globalizada.

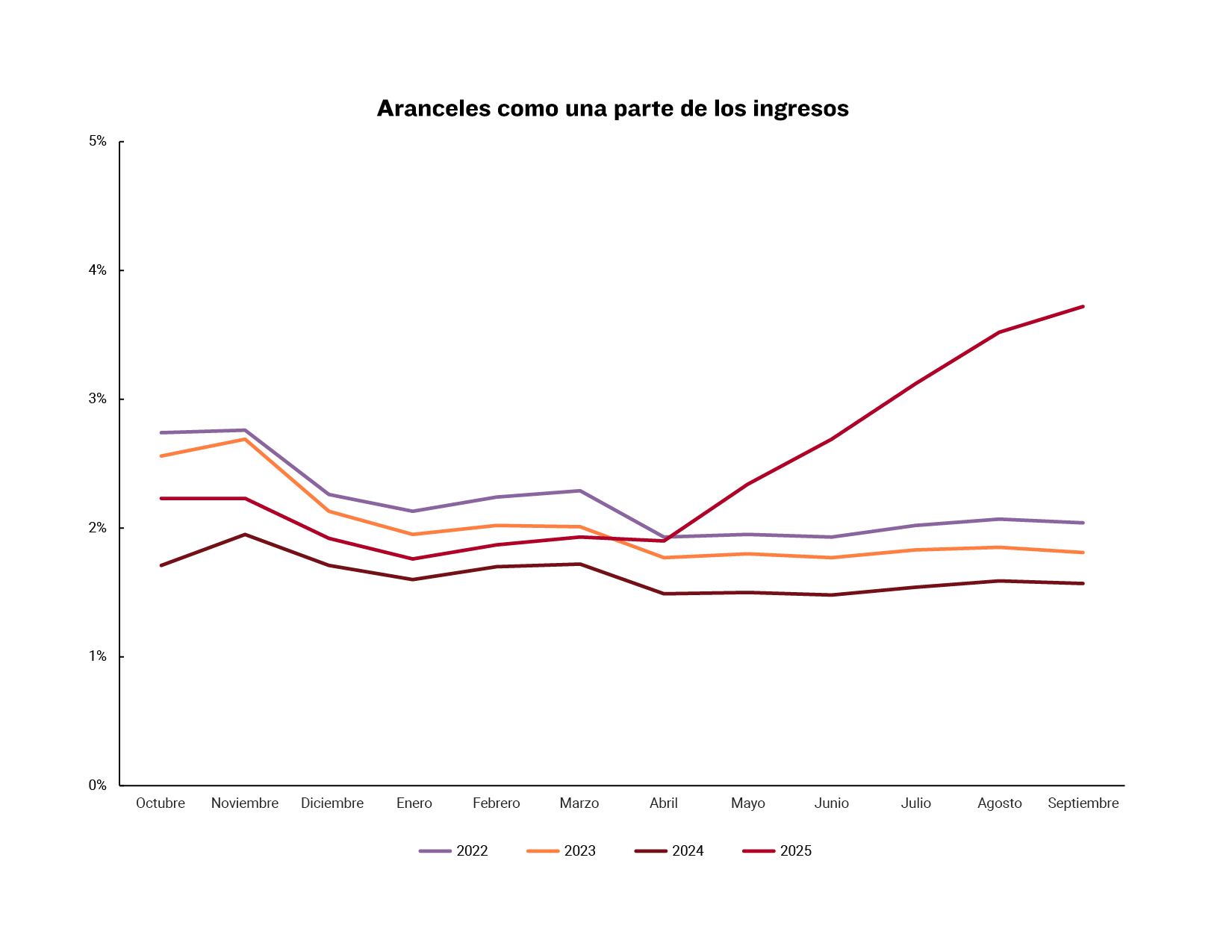

Algunos de estos efectos son más claros de ver que otros. Tomemos los ingresos, por ejemplo. Los aranceles brutos y algunos otros impuestos especiales de consumo han generó ingresos por $264.7 mil millones de dólares UU., A partir del 18 de diciembre, según datos del Centro de Política Bipartidista, calculados a partir de estados de cuenta diarios del Tesoro. Eso es alrededor de un 141% más que la cantidad de ingresos generados por los aranceles brutos y otros impuestos especiales en ese momento en 2022.

Sin embargo, también es importante tener en cuenta el panorama general en torno a los aranceles, dijo Brian Henderson, director de inversiones en BOK Financial®.

"Los aranceles no se tratan solo de ingresos; crean una ventaja para las empresas que ya operan en los Estados Unidos y se han utilizado como una herramienta de negociación para atraer inversión extranjera aquí", dijo. "Esa dinámica de negociación no es algo que hayamos visto a esta escala antes".

Más claridad que antes, pero persiste cierta incertidumbre

Al entrar en 2025, ya estaba claro que los aranceles serían una parte importante del impulso de la administración Trump para revivir la fabricación estadounidense y reducir el déficit comercial de Estados Unidos. Sin embargo, muchos de los detalles que rodean a los aranceles, incluidos su tamaño y alcance, siguieron siendo un comodín. Además, a medida que se desplegaban, fue una sorpresa tras otra, dijeron los expertos.

"Al principio, pensamos que la política arancelaria significaría tasas recíprocas: si usted arancela mis exportaciones al 10%, yo aranclé las suyas al 10%", dijo Steve Wyett, director especialista en estrategia de inversiones en BOK Financial. "En cambio, lo que obtuvimos fue una fórmula complicada vinculada a los déficits comerciales, lo que llevó a aranceles tan altos como 40%, 60% e incluso 80% sobre ciertas importaciones".

En un momento dado, los aranceles sobre los productos chinos se acercaron a niveles equivalentes a un embargo comercial, enviando ondas de choque a través de los mercados globales y provocando temores de una recesión. Aunque esos peores escenarios se han descontado desde entonces, sigue habiendo cierta incertidumbre.

"La incertidumbre es lo peor para los mercados"

A su vez, esta incertidumbre se ha convertido en uno de los vientos en contra más importantes para los mercados globales. La imprevisibilidad de las estructuras arancelarias, pasando de expectativas recíprocas a cálculos basados en el déficit, creó confusión tanto para las corporaciones multinacionales como para los inversores, dijeron los expertos.

Aunque esos temores se han moderado desde entonces, señalaron que la volatilidad sigue siendo una característica definitoria del entorno actual. "La incertidumbre es lo peor para los mercados", dijo Wyett. Cuando las empresas no pueden pronosticar los costos o los flujos comerciales, retrasan los gastos de capital y la contratación, lo que ralentiza el impulso económico. Para los inversores, esto significa descontar el riesgo geopolítico como un factor permanente en lugar de una interrupción temporal, un cambio que, según los expertos, podría remodelar las estrategias de cartera en los próximos años.

A pesar de las turbulencias, las acciones internacionales han registrado recientemente ganancias relativas, impulsadas por ajustes de política y estímulos fiscales en los mercados extranjeros. Sin embargo, los expertos advirtieron contra la extrapolación del desempeño a corto plazo a una tendencia estructural. Como dijo Wyett: "Si miro en los últimos 15 años, ni siquiera está cerca: las acciones nacionales han superado con creces a las acciones internacionales".

Mirando hacia el futuro

A medida que los regímenes arancelarios se estabilicen y los nuevos corredores comerciales tomen forma, puede significar una economía mundial menos eficiente, pero también una que sea más resistente a choques como pandemias y conflictos geopolíticos. Matt Stephani, presidente de Cavanal Hill Investment Management, Inc., una subsidiaria de BOKF, NA.

"Cuando controlas más de tu cadena de suministro a nivel nacional, reduces el riesgo de eventos de cisne negro. Ya no se trata solo de economía; Se trata de resiliencia en un mundo donde los choques geopolíticos son cada vez más frecuentes", dijo.

Y no es solo la economía estadounidense la que puede volverse más resistente, sino también algunas compañías estadounidenses, especialmente aquellas en industrias clave como semiconductores, productos farmacéuticos y defensa. Como dijo Henderson: "Estamos entrando en un período en el que la eficiencia puede pasar a un segundo plano frente a la resiliencia. Las empresas están dispuestas a pagar más por el control de sus cadenas de suministro, y ese es un cambio estructural que definirá el comercio mundial durante años".

Para los mercados, ese cambio representa tanto un desafío como una oportunidad, que según los expertos puede redefinir los contornos de la inversión global en los próximos años. En palabras de Stephani: "Es probable que cree oportunidades para la innovación, para que las nuevas empresas aprovechen la cuota de mercado y para que las economías de los países prosperen, si se toman buenas decisiones políticas".

"El comercio global se está redefiniendo", dijo Henderson. "Ya no se trata solo de costos: se trata de control, seguridad y adaptabilidad. Ese cambio creará ganadores y perdedores, y las empresas que inviertan temprano en cadenas de suministro resilientes tendrán una ventaja competitiva".