Already-strong January setting the tone for markets

Early momentum, tax changes and consumer strength could shape 2026

PUNTOS CLAVE

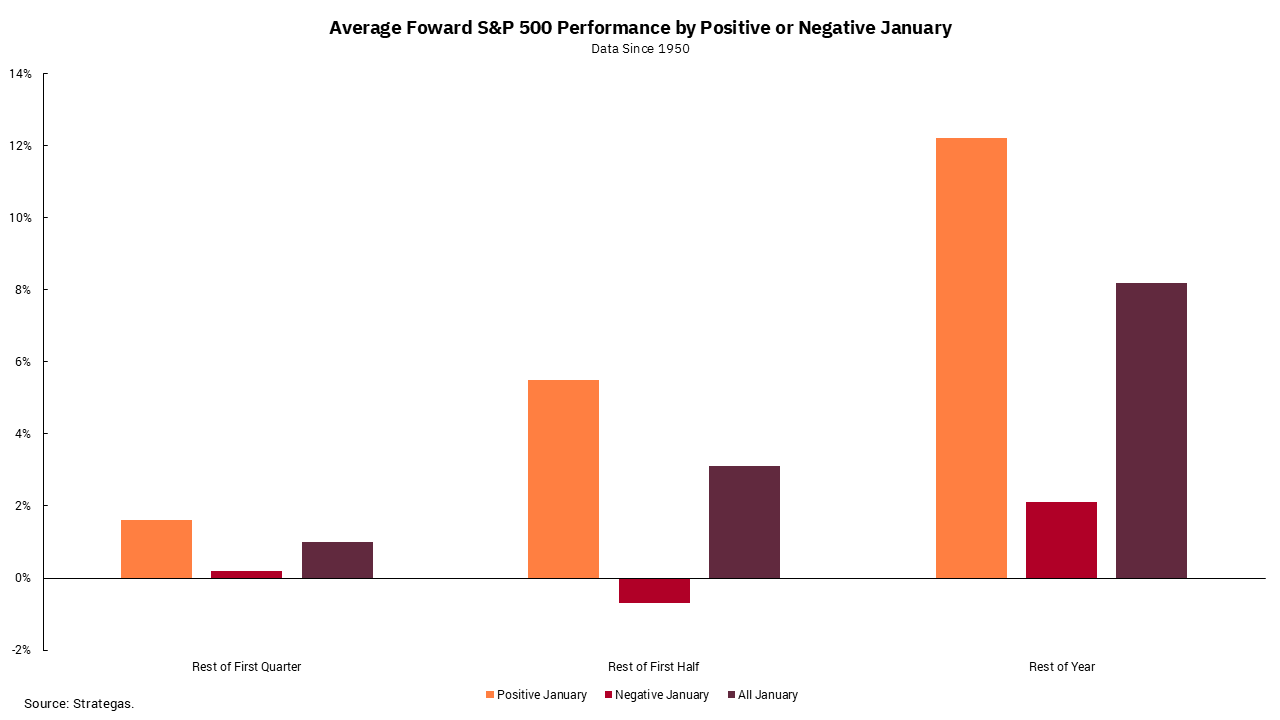

- Historically, positive January performance has correlated with stronger first-quarter, first-half, and full-year equity returns.

- Early signs of economic momentum, including job growth and tax policy changes, point to a supportive environment for consumers and businesses.

- Increased tax refunds, lower withholding rates and corporate incentives could fuel spending and investment, driving growth in 2026.

Historically, the month of January has been an important barometer when we think about the performance of equity markets for the upcoming year. Our chart this week provides data since 1950 to show why. While overall average performance is positive (recall the stock market is up roughly 70% of the time on a yearly basis), it is clear that performance is better for the firstquarter, first-half, and yearly time frames if performance is positive in January.

The month is far from over, but the start to the year has been positive. Recent data on fourth-quarter growth indicates some momentum going into the new year, and December's job report showed the unemployment rate fell to 4.4% by the end of the year. At the base of our optimism for economic growth in 2026 is a sense that the U.S. consumer will remain supported by a stable job market and begin to see the benefits from some of the changes in the extension of the Tax Cuts and Jobs Act-i.e., the One Big Beautiful Bill Act.

Looking forward, tax-refund season should see an aggregate increase in refunds approaching $150 billion. That's roughly a $1,000 increase per taxpayer. Tax-withholding rates for 2026 will also be lower to account for additional tax breaks on tips and overtime, which will increase paychecks. As consumer spending is responsible for roughly two-thirds to 70% of gross domestic product (GDP), a consumer with more money is a tailwind for growth.

The changes on the corporate side are material as well. with incentives for corporations to build plants, purchase equipment and increase capital expenditure overall. Over time, these incentives should increase job opportunities and allow companies to avoid tariff policies while gaining more control over production and distribution. There are also potential positive impacts to national security, which we discuss in our annual market outlook.

Recent news about potential changes to housing policies-such as reducing federal regulations, limiting institutional buyers of single-family homes and increasing purchases of mortgage-backed securities by Fannie Mae and Freddie Mac-could help boost demand. However, the primary challenge in the housing market continues to be the lack of supply.

In aggregate, it would seem this midterm election year might be very active, as the administration-like most every administration before it, regardless of party affiliation-tries to ensure economic growth is positive. There are obvious reasons for caution, and recent events in Venezuela show that geopolitical risk is very hard, if not impossible, to predict, but the economic momentum remains positive. Here's to 2026 being the best year ever for us all.

Obtenga los números entregados en su bandeja de entrada.

Suscríbase (Se abre en una pestaña nueva)