La infraestructura de IA puede impulsar el crecimiento durante décadas

El impulso económico podría ayudar a aliviar las preocupaciones sobre la deuda federal, pero las preocupaciones energéticas se ciernen

Este artículo forma parte de nuestra próxima Perspectiva anual de los 2026 mercados. Pulse aquí para visitar nuestra página web de Outlook y registrarse para la discusión en vivo, que se llevará a cabo el 15 y 2026 de enero a las 11 am CT.

PUNTOS CLAVE

- Las inversiones en infraestructura de IA pueden impulsar el crecimiento económico estadounidense a largo plazo y ayudar a estabilizar las relaciones deuda/PIB.

- Las ganancias de productividad de la IA podrían compensar la escasez de mano de obra y remodelar la eficiencia empresarial en todas las industrias.

- La creciente demanda de energía de los centros de datos amenaza con convertirse en un cuello de botella, lo que hace que la política energética sea crucial para sostener el crecimiento impulsado por la IA.

La inteligencia artificial (IA) está emergiendo como una palanca estratégica para la competitividad de Estados Unidos, con el potencial de impulsar el crecimiento económico y ayudar a evitar una inminente crisis de deuda, pero el aumento resultante en la demanda de energía puede significar precios más altos de la energía y sigue siendo un riesgo para el dominio estadounidense de esta nueva tecnología.

Esa es la oportunidad, y también el enigma, que enfrenta Estados Unidos. Aún así, es importante no subestimar los efectos transformadores que la IA puede tener para los consumidores, las empresas y la economía en general, dijeron los expertos.

Como director de inversiones de BOK Financial® Brian Henderson "El acceso a energía confiable y abundante es clave para el crecimiento continuo, pero igualmente importante es cómo la IA puede hacer que las empresas sean más eficientes. Eso es lo que impulsa la competitividad a largo plazo".

Esta ventaja que la IA puede proporcionar se reduce a aumentar la productividad económica y, a su vez, el crecimiento económico tanto a corto como a largo plazo, pero todavía hay muchas variables en juego.

"Estamos en la fase de construcción de la IA, y eso apoya el crecimiento en los próximos años", dijo Matt Stephani, presidente de Cavanal Hill Investment Management, Inc., una subsidiaria de BOKF, NA. "Sin embargo, si la IA realmente transforma la forma en que trabajamos, podría proporcionar un impulso de productividad a largo plazo que podría acelerar el crecimiento económico. A medida que el crecimiento se acelera, los mercados financieros también pueden ver rendimientos positivos".

Potencial para una mayor productividad y eficiencia de los trabajadores

El mayor impacto económico de la IA probablemente provendrá de las ganancias de productividad, especialmente Si la fuerza laboral se reduce de los Baby Boomers que se jubilan y políticas de inmigración más estrictas. "La producción económica es una combinación de productividad y el tamaño de su fuerza laboral", dijo el director de inversiones de BOK Financial Steve Wyett. "Si el tamaño de la fuerza laboral está disminuyendo, Estados Unidos necesitará más productividad de los trabajadores y la IA para ser lo más poderosa posible".

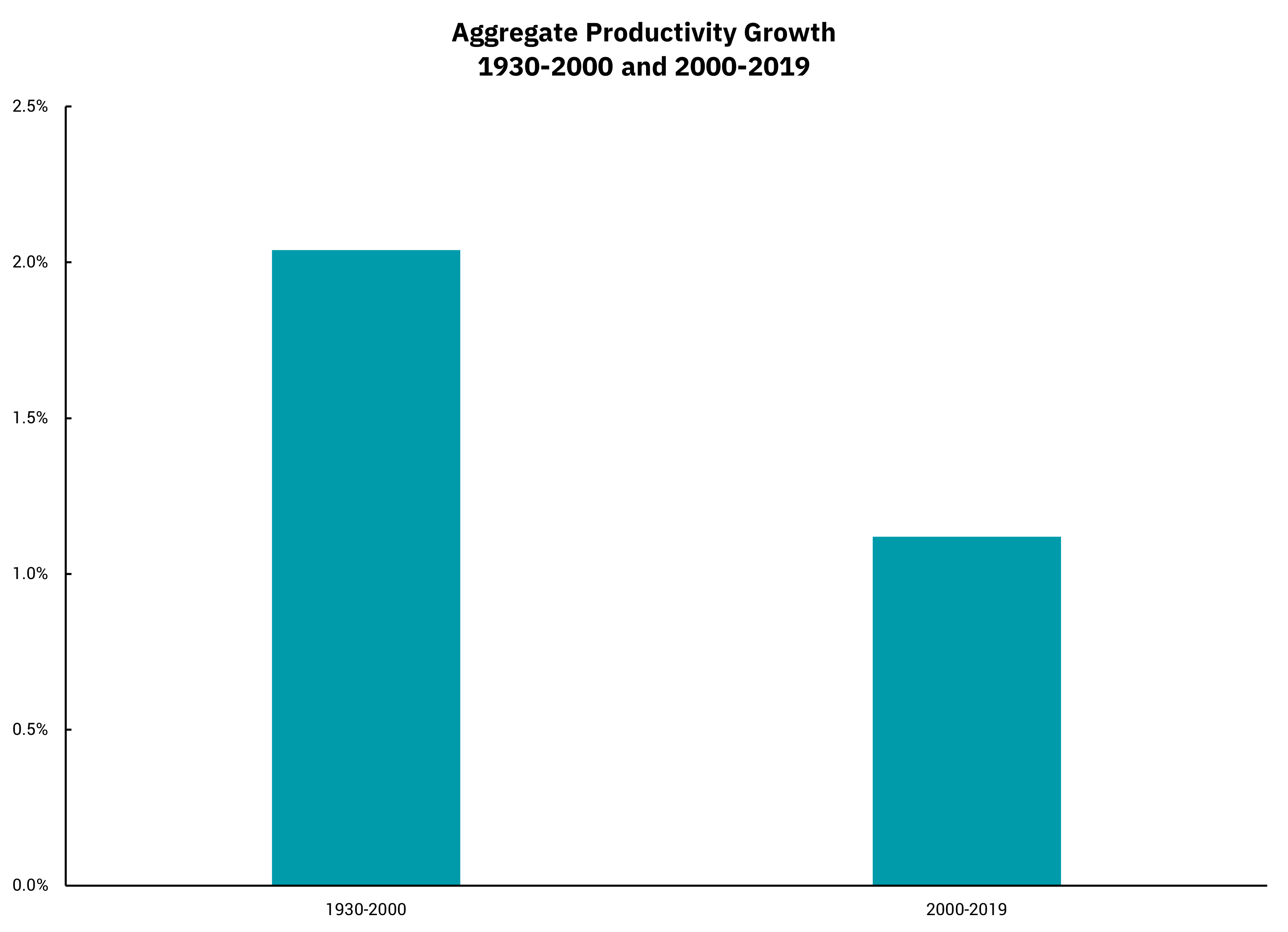

Si la IA aumenta la productividad, se revertiría La tendencia de un crecimiento más lento de la productividad Visto desde 2000, después de que se realizaron las ganancias del auge de la productividad impulsado por la tecnología de los años 1980 y 1990.

Las herramientas de IA ya pueden realizar rápidamente tareas que antes requerían horas de esfuerzo humano. Wyett dio el ejemplo de analizar presentaciones corporativas y destilarlas en resúmenes de una página.

Al igual que las eficiencias impulsadas por la tecnología creadas por Internet, lo que hace que los beneficios potenciales de la IA sean diferentes de otras olas históricas de industrialización, como la mecanización de la agricultura, es el tipo de trabajadores que pueden verse afectados. Con la IA, incluso más de lo que fue el caso con Internet, tanto las personas con altos ingresos como las que ganan poco pueden verse afectadas, coincidieron los expertos.

Aunque algunos tipos de trabajos pueden volverse obsoletos, la IA también creará una mayor demanda de otros tipos de roles, como ingenieros de IA, técnicos de centros de datos y especialistas nucleares para la expansión de energía, señaló Stephani.

En otras palabras, no habrá escasez de trabajo para que la gente lo haga.

Por qué es importante el crecimiento

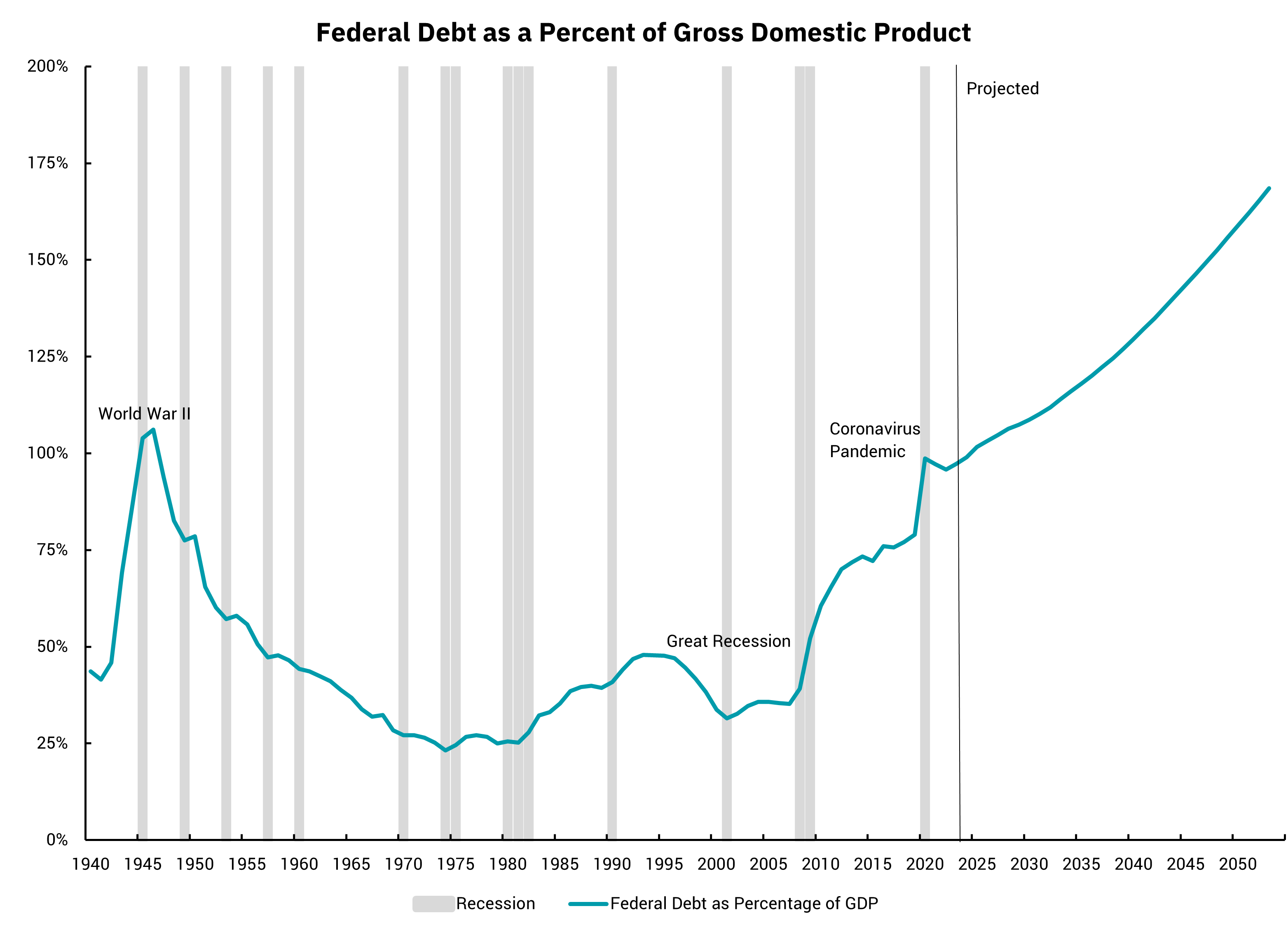

A su vez, este aumento de la productividad económica podría elevar el producto interno bruto (PIB) de Estados Unidos, lo que podría cambiar la trayectoria de las relaciones deuda federal/PIB. "Si Estados Unidos crece al 1,6% anual, nuestra relación deuda-PIB podría seguir explotando", dijo Stephani. "Sin embargo, si podemos aumentar nuestra tasa de crecimiento en solo 50 puntos básicos, la relación deuda/PIB se mantiene estable".

A diferencia de las medidas de estímulo de corta duración, las inversiones en IA crean una capacidad duradera (centros de datos, fábricas de semiconductores e infraestructura avanzada) que podrían impulsar la economía durante décadas, coincidieron los expertos.

Los "hiperescaladores" de IA como Amazon, Microsoft, Alphabet, Meta y Oracle ya están comprometiendo cientos de miles de millones para la infraestructura de IA. Meta, Amazon, Alphabet y Microsoft solo tenían la intención de gastar un total combinado de $320 mil millones sobre tecnologías de IA y construcciones de centros de datos en 2025, según los comentarios de sus CEO y las llamadas de ganancias, según CNBC.

"Estos proyectos ofrecen un doble beneficio", dijo Stephani. "En el corto plazo, la actividad de la construcción impulsa el PIB y las economías locales. A largo plazo, los activos en sí mismos (plantas de chips, centros de datos) se convierten en motores de productividad. Piense en ellos como lo haría con los ferrocarriles, que se construyeron hace más de 100 años pero que todavía proporcionan productividad en nuestra economía actual".

Hasta ahora, los principales beneficiarios de esta inversión en infraestructura de IA han sido los propios centros de datos, las personas que los refrigeran y colocan equipos, y los proveedores de energía de servicios públicos. Las compañías que se beneficiarán del uso de la IA, como los productos farmacéuticos que hacen descubrimiento de fármacos, estarán en la próxima ola de beneficiarios, continuó Stephani.

Y estos beneficios tienen el potencial de ser exponenciales, dijo Henderson. "Las empresas que integran la IA de manera efectiva no solo reducirán los costos, sino que también desbloquearán flujos de ingresos completamente nuevos. Ahí es donde radica la verdadera ventaja competitiva", explicó.

La energía puede ser el cuello de botella

Y, sin embargo, la abeja en el ungüento de todo esto podría ser el poder. "La IA no se trata solo de algoritmos; Se trata de combinar la innovación con la infraestructura. Si no resolvemos el cuello de botella energético, corremos el riesgo de quedarnos atrás a nivel mundial", dijo Henderson.

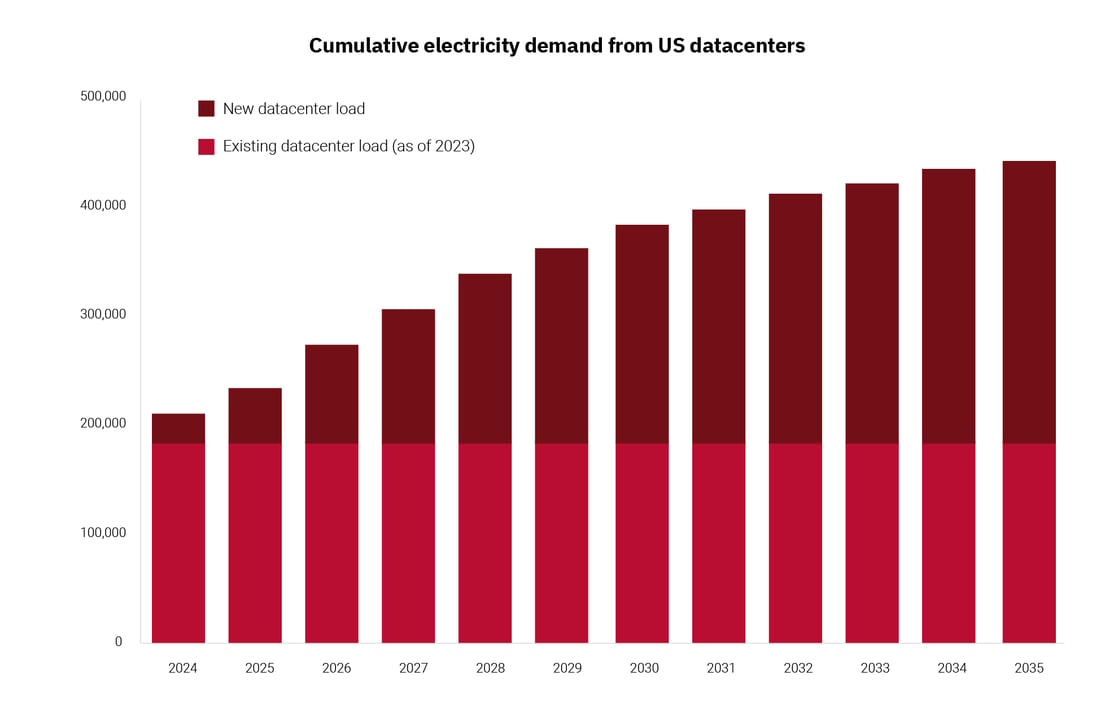

Las demandas de infraestructura de la IA son inmensas, y la red de Estados Unidos ya está tensa. "Los centros de datos se conectan más rápido de lo que se puede poner en línea la capacidad de energía", dijo Wyett. "La red no ha tenido muchas inversiones nuevas".

La demanda de electricidad, plana durante dos décadas, ahora está aumentando y elevando los precios con ella. Desde 2022, el aumento de los precios minoristas de la energía ha superó a la inflación en general, según la Administración de Información de Energía de los Estados Unidos (EIA).

Además, este aumento de la demanda de energía probablemente ejercerá una presión adicional sobre la red eléctrica. Sin mejoras, regiones como Arizona, Texas y el Atlántico medio podrían enfrentar caídas de tensión durante los períodos pico, dijo Wyett.

Por estas razones, la política energética de Estados Unidos será crucial para determinar el camino a seguir, coincidieron los expertos. Como explicó Henderson, "la energía no es solo un factor de costo; es la base para el crecimiento de la IA. Sin energía confiable y asequible, toda la inversión en centros de datos y chips no ofrecerá la ventaja competitiva que buscamos".