La Fed rebaja las tasas por primera vez desde diciembre

La medida podría ser la primera de tres recortes antes de fin de año

PUNTOS CLAVE

- La Fed recortó las tasas por primera vez en nueve meses, con el objetivo de apoyar un mercado laboral debilitado mientras mantiene la inflación bajo control.

- Los expertos predicen dos recortes adicionales de tasas en 2025, con un posible cuarto a principios de 2026 para alcanzar una postura de política neutral.

- Si bien la inflación sigue siendo una preocupación, la desaceleración del crecimiento del empleo y el impulso económico están impulsando el cambio de la Fed hacia la flexibilización.

Después de nueve meses de mantener las tasas estables, el Comité Federal de Mercado Abierto (FOMC) decidió el 17 de septiembre reducir la tasa de los Fondos Federales en un 0.25%, mientras se esfuerzan por equilibrar el apoyo al enfriamiento del mercado laboral con mantener la inflación bajo control.

Mientras tanto, ambos lados del mandato de la Reserva Federal -lograr el pleno empleo, por un lado, y mantener la inflación cerca del 2%, por el otro- permanecen fuera del objetivo, dijo Brian Henderson, director de inversiones de BOK Financial®.

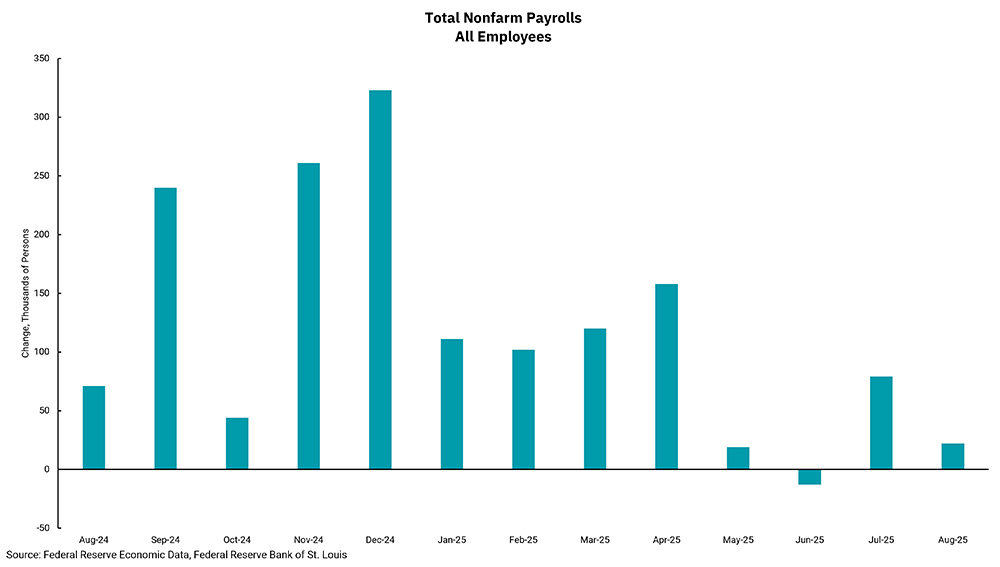

"Aunque no está en niveles recesivos, el mercado laboral está mostrando signos de deterioro", dijo. "El crecimiento del empleo se ha desacelerado a un goteo y la tasa de desempleo está empezando a subir. Una vez que el desempleo comienza a aumentar, ha tenido una tendencia a cobrar mucho impulso y puede alimentarse de sí mismo, por lo que a menudo aumenta aún más".

Él y otros expertos destacan que el Tasa de desempleo más reciente-4.3%, a partir de agosto-es todavía relativamente bajo desde un punto de vista histórico. Sin embargo, esa cifra probablemente sería mayor si no fuera por el envejecimiento demográfico de EE. UU. y Políticas de inmigración más estrictas, que están reduciendo el número de personas en edad de trabajar en el país.

Cuando la economía, incluido el mercado laboral, se está debilitando, los bancos centrales como la Reserva Federal a menudo bajan las tasas de interés para tratar de estimular el crecimiento económico, pero eso también aumenta el riesgo de aumento de la inflación, poniendo a los bancos centrales en un enigma cuando tanto una economía en desaceleración como una alta inflación son factores.

El mercado laboral está peor de lo que se pensaba

Aunque el mercado laboral de EE. UU. ya había estado mostrando signos de enfriamiento, hasta hace poco, la inflación parecía ser la mayor preocupación para la Fed. No solo la inflación estuvo por encima del objetivo del 2% de la Fed, que todavía lo es, sino que las políticas federales sobre aranceles y inmigración exacerban aún más el riesgo de que los precios suban, dijo Henderson.

Sin embargo, cuando el Se publicó el informe de empleos de julio, reveló que el mercado laboral estaba en realidad peor de lo que muchos pensaban. "No solo el crecimiento del empleo en julio fue débil, sino que los dos meses anteriores de aumentos de empleos también se revisaron a la baja, y luego eso Lo mismo sucedió de nuevo en el informe de agosto", explicó Henderson.

En conjunto, este y otros datos indicando un debilitamiento mercado laboral elevó las posibilidades de un recorte de tasas de la Fed este mes al 100%. Y así, al entrar en la reciente reunión del FOMC, la pregunta no era "¿reducirán las tasas?" sino más bien "cuánto recortarán". Con esto en mente, Henderson cree que el FOMC recortará las tasas en un 0.25% nuevamente en sus reuniones de octubre y diciembre, con un recorte más probablemente a principios de 2026, para un total de una caída del 1% necesaria para bajar a una tasa de fondos federales "neutral" que no sea restrictiva ni estimulante para el crecimiento económico.

Cambios en el número de empleos no agrícolas en EE. UU.

La inflación sigue siendo un riesgo, pero menor

Mientras tanto, cuanto más baje la Reserva Federal las tasas, más riesgo habrá un aumento de la inflación. Sin embargo, según los datos actuales, parece ser uno bajo en comparación con el riesgo de una desaceleración de la economía y, con ello, un mercado laboral que se debilite aún más, señaló Henderson.

Además, los aranceles pueden aumentar un poco los precios, aunque es probable que sean solo aumentos de precios únicos, dijo, y algunos de los efectos de los aranceles pueden no transmitirse a los consumidores en absoluto.

"Una vez que los aranceles están en vigor, las empresas que importan bienes de países que se ven afectados por los aranceles tienen opciones. Pueden absorber parte del aumento del precio o pueden tratar de pasar solo parte del aumento del costo a los consumidores. Las empresas que exportan bienes a los Estados Unidos también pueden absorber algunos de los costos de los aranceles. Las tres opciones, que mitigan el impacto de los aranceles en los consumidores estadounidenses, ya están sucediendo", explicó.

La economía podría seguir desacelerándose

La decisión de la Fed de recortar las tasas ayudará a algunas áreas de la economía y los mercados, como las acciones financieras, los bonos a corto plazo y las acciones de empresas pequeñas y medianas que tienen mayores cantidades de deuda, siempre y cuando Estados Unidos no entre en recesión, dijo Henderson. Si las tasas hipotecarias caen, lo cual no es una certeza, eso podría ayudar al mercado de la vivienda, así como a las industrias que coinciden con él.

Además, si la Fed reduce las tasas y otros bancos centrales continúan manteniendo las suyas estables, el dólar estadounidense probablemente caería frente a las monedas de esos países. Si eso sucede, impulsaría las exportaciones estadounidenses y, con ellas, el crecimiento del producto interno bruto (PIB), pero aumentaría los precios de los bienes importados a los Estados Unidos, señala Henderson.

Incluso con la Fed recortando las tasas, es probable que el crecimiento económico se mantenga débil por ahora, pero Henderson no cree que Estados Unidos se dirija a una recesión en este momento. En cambio, el crecimiento económico -y, con él, una mejora en el crecimiento de nuevos empleos- puede estar en el horizonte para 2026.